The article below provides an overview of the challenges facing policy makers in India. For information regarding global fertilizer prices, please contact us for a free trial of any of our global fertilizer market reports.

India’s new BJP-led Government utilised its first Union Budget to confirm its intention to review the existing urea subsidy arrangement. Urea reform has long been a hot topic in India and in the run up to the Budget media reports indicated that the Government was contemplating a 10% increase in the domestic retail price of urea (from the current Rs 5,360pt). Shortly after, a swift denial was issued by Fertilizer Minister Ananth Kumar.

However, the Indian government faces a number of challenges when it comes to the country’s urea use and it seems clear that reform is on the cards. The latest Budget noted that:

“What is urgently required are certain pricing reforms in the urea sector with an immediate price correction for urea, new Nutrient based Urea Policy. This is not only essential from viewpoint of the size of the subsidy bill but also from the viewpoint of balanced use of N, P & K nutrients.”

So, what are the drivers for reform?

1a) The fiscal challenge: the cost of domestic production

India’s consumes over 30m. tonnes of urea every year and the product is the only fertilizer product subject to a Maximum Retail Price set by the Government. This is currently Rs 5,360pt – around $90pt.

Around 75% of the urea consumed in India is produced domestically. Under the existing urea subsidy arrangement, domestic producers receive a payment for the difference between the MRP and cost of production. India does not benefit from access to cheap gas, and has recently offered financial incentives through the proposed NPS scheme to under-utilized existing production facilities to restart production. Of the plants that currently run, some even rely on imported LNG during periods when gas needs to be allocated to other sectors.

With gas market reform and gas allocation an equally contentious issue in India, increasing feedstock costs represent a further threat to the Government’s subsidy bill. Indeed, the Government has been encouraging private investment abroad to meet India’s urea needs – six JVs have been formed to this end.

1b) The fiscal challenge: the cost of importing urea

Domestic production alone does not support India’s urea requirement, with around 8m. tonnes a year imported. Purchasing tenders are held throughout the year. Again, this places a significant fiscal burden on the Government. At the last purchasing tender, delivered at port prices were over $170pt greater than the MRP.

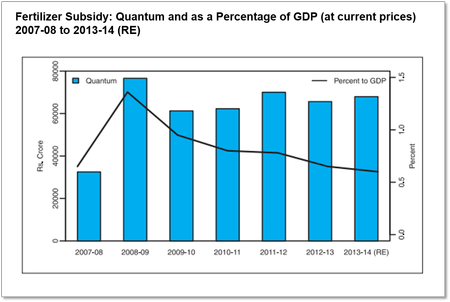

Under the current subsidy arrangement, the Indian Government is cleary faced with a huge financial burden, although the graph above shows that this has fallen in as a percentage of GDP. The current fertilizer subsidy bill is around $11 billion, with urea representing almost half of this. This subsidy is widely report to have quadrupled over the last ten years. In addition, domestic producers have long complained that subsidy payments are delayed and that an increase in urea prices is also required.

2) The Nutrient Based Subsidy Scheme and the overuse of urea in India

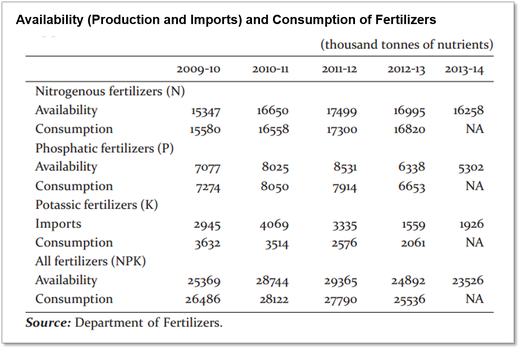

Urea is not part of the Nutrient Based Subsidy Scheme introduced in 2010. Applied to phosphates, potash and complex fertilizers, the policy provides a fixed amount of subsidy determined by the nutrient content of fertilizers. The retail price of individual fertilizer producers is determined to a degree by the market. Urea consumption continues to grow year by year, rising from 59 per cent of all fertilizer use to 66 per cent since 2009/10. During this period though, overall consumption of fertilizer per hectare fell from 140kg to 128kg. As such, the introduction of the NBS is widely credited with leading to imbalanced use of fertilizer in India. In short, urea is perceived to be overapplied and relied upon by farmers at the expense of other fertilizers.

Next steps for the Government

As highlighted above, the new Government is now having to review a complex set of policies that currently shape fertilizer use and production in India. Further announcements related to the Nutrient Based Subsidy scheme, efforts to increase domestic production and gas feedstock costs are expected in the coming weeks and months. Profercy expects to publish blog entries on these as the debate evolves.

About Profercy

Profercy publishes regular market updates and weekly reports on all major fertilizer products used in India through Profercy Nitrogen, Profercy Phosphates & NPKs and Profercy Potash. These reports provide the latest news, detailed analysis, and also forecast reports for all major products in the global fertilizer industry. While our reports focus on trade and the global market, this blog is also utilised to provide overviews of key influences on production, trade and consumption.

For a free trial of any of our reports, please click here to send us your details.