The near-term fortunes of the urea market continue to be defined by the 1 July MMTC India tender, with several traders still looking to cover awards.

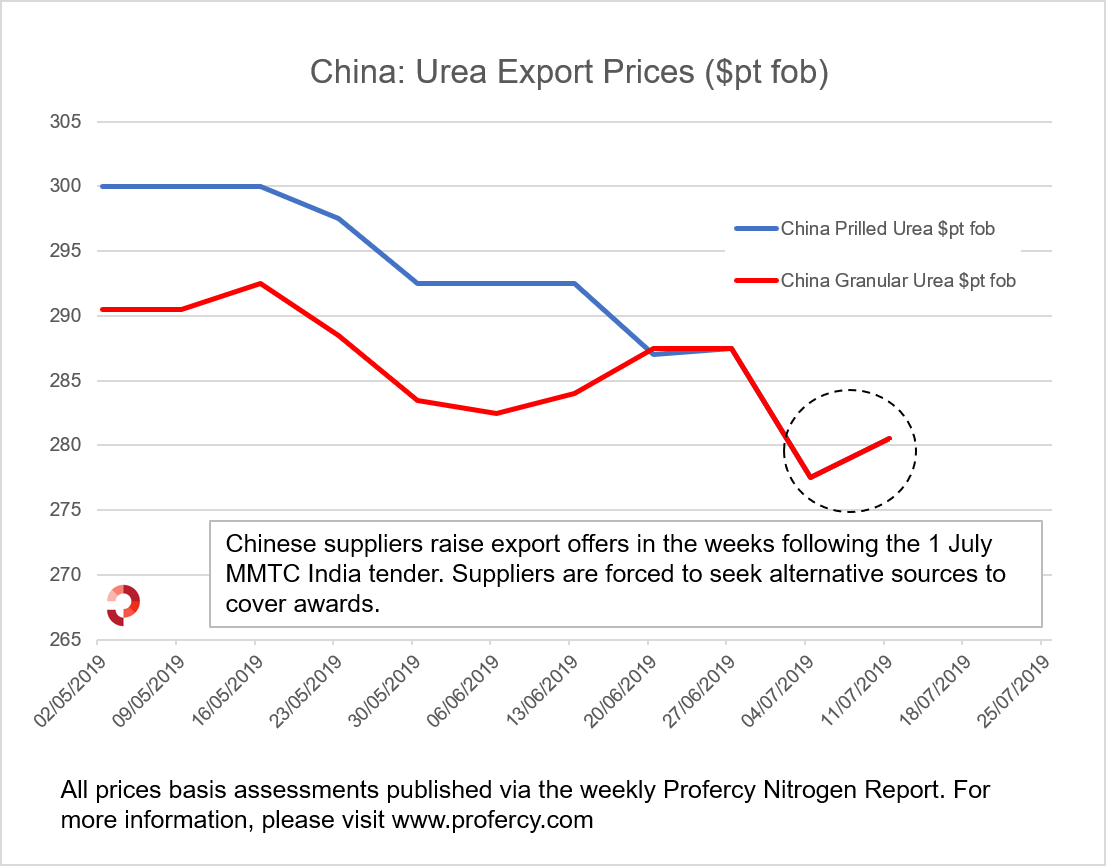

In the aftermath of the Indian purchasing tender, Chinese suppliers raised offer levels with some seeking extensions for earlier sales beyond the 16 August shipment deadline. Logistical challenges and a potential shortfall of product availability has seen Chinese suppliers raise price ideas to the low-$280s pt fob and above for both prills and granular. The majority of these offers have been for small 10-15,000t lots. This follows earlier sales in the high-$270s pt fob, in line with netbacks from India.

Given this, traders short against the Indian business reacted last week and moved to cover from other origins. One 50,000t August shipment was booked from Oman with the sales price $5pt above business the previous week. A further 200,000t of material was booked from the FSU and one cargo also secured in Indonesia. All of the sales, with the exception of the Baltic, were concluded at prices above last done, with most above breakeven levels for India.

As reported previously, the lowest east coast offer was $292.63pt cfr Gangavaram, with lowest on the west coast at $295.97pt cfr. Prior to the tender, cfr prices were expected to be higher but a flood of offers from China shortly before the tender convinced many in the trade to lower offers. MMTC subsequently booked around 1.7m. tonnes, well above earlier expectations, with estimates suggesting up to 1.1m. tonnes of these awards were basis anticipated availability from China. As noted in our earlier coverage, and is now clear, this included significant short selling.

Further business is anticipated in the coming days with at least 4-5 cargoes still required for India by traders. This may prove difficult with the recent round of sales in the east and west soaking up a large proportion of available tonnage for shipment in the next 30 days. Nevertheless, producers and suppliers will be mindful that western demand has been slow, especially with Brazil yet to compete for import tonnes.

By Chris Yearsley, Nitrogen Market Editor, and Michael Samueli, Nitrogen Market Reporter and Analyst