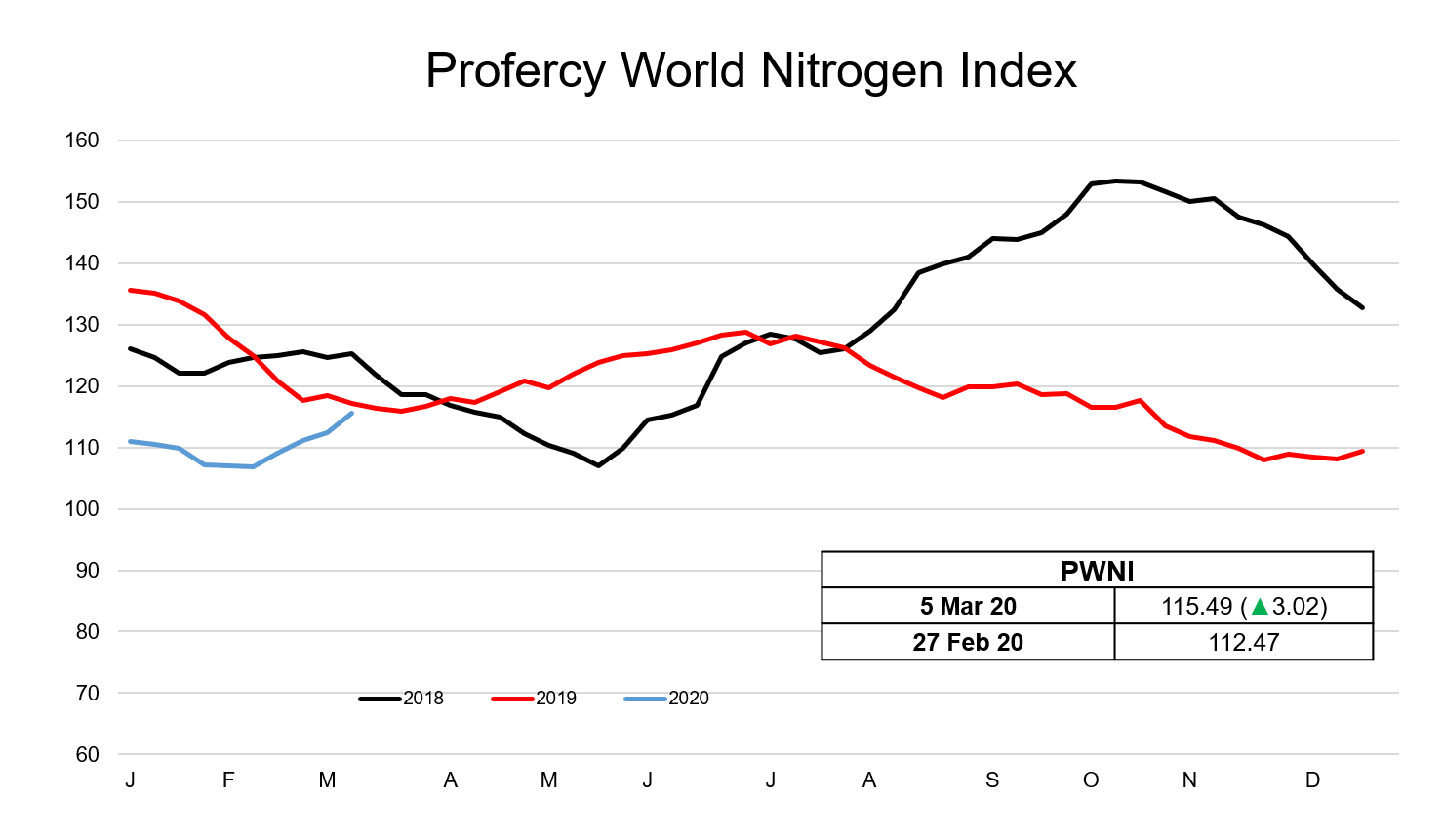

While the impact of the coronavirus is now having a profoundly negative impact on energy prices and forecasts for World economic growth, for now the urea market is proving immune to the bearish contagion with supply tight and prices moving higher. Indeed, it has been a lively week with fob prices advancing in the east and west.

The latest rally has been spurred by import demand for the US Gulf, but has been sustained by several major import markets stepping up early in the east and west. Many are mindful of a tight market near-term owing to China’s absence from the export market, as well as imminent Indian demand.

Egyptian granular urea values have now advanced to the mid-$260s pt fob while Middle East producers have consolidated prices at or above $250pt fob with at least one sale in the high-$250s pt fob for April shipment. In a tender today, Indonesian granular urea producer Kaltim received bids for granular urea up to $261pt fob, well above the tender reserve price of $247.50pt fob. The tender saw several bids from traders for 40-45,000t in the mid to high-$250s pt fob.

US demand limits western supply for other markets

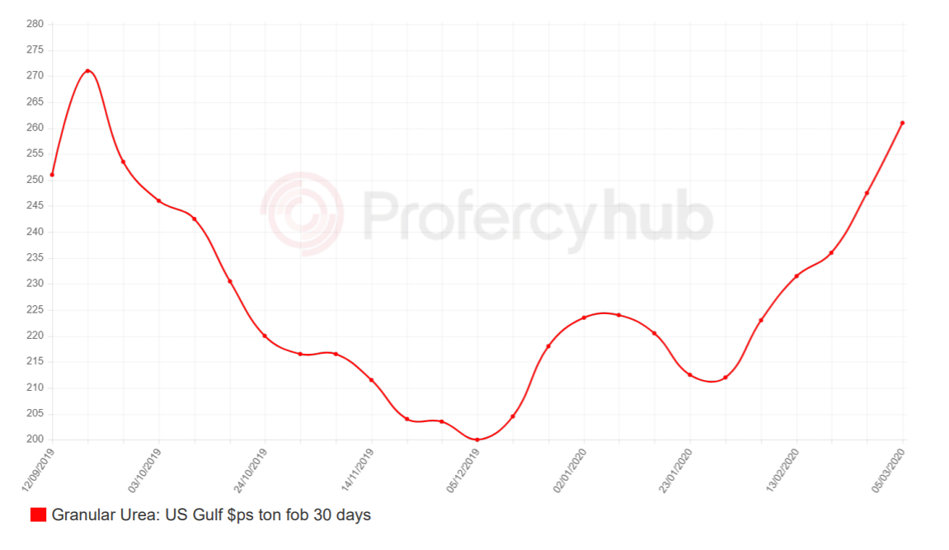

In the west, producers have benefitted from the continued price gains in the US. This has forced buyers elsewhere, including Europe and Latin America, to raise price ideas in order to secure March and April shipments. Nola barge values have escalated quickly, driven by the well documented shortfall in import volumes, slim availability of March barges and some moderate demand for southern US markets. Prompt and March barge business has been concluded this week at $270ps ton fob Nola, $60ps ton above the lowest levels seen in the market at the beginning of February.

With the US market leading to demand for shipments from Egypt, Algeria and Russia, buyers in Latin American moved quickly in February to secure tonnes ex-Middle East and Algeria. This includes importers in Argentina, Uruguay and Mexico, where major import demand tends to emerge in Q2. Importers in Europe have been forced to pay higher levels for small shipments to France, Italy and Spain.

China’s absence increases Australia’s reliance on other origins

In the east, China’s disinterest in the export market is notable. Operating rates have improved in the past few weeks, but domestic supply has been tight enough to lead to major price gains, in part due to refill demand for the coming application season, as well as demand from the NPK and industrial sectors. This is in stark contrast to last year, when China was incredibly active in the international market.

China’s absence is significant at a time when good rainfall has led to buoyant import demand in Australia. In February, Arab Gulf and SE Asian producers had been reliant on US demand to move February and early March shipments. However, Australian buyers, mindful of India’s widely anticipated return to the market have stepped in over the last 14 days to secure major volumes. This includes up to three Middle East cargoes booked in the past week at ever higher prices.

For the time being, the current optimism in the market shows no signs of letting up. Producers are confident with orders on the books for shipments well into April and basis anticipated demand in both the USA and India.

by Chris Yearsley, Editor, Profercy Nitrogen, (London, 6 March 2020)