Mid-July saw Profercy’s Nitrogen Index at its lowest level since the 2009 start date. However, international urea prices gained towards the end of the month and the market was stable to firm throughout August. Black Sea prilled urea prices are currently $15-20pt above the low levels seen in July, while Egyptian granular urea has gained close to $15pt. Offers of ammonium nitrate have jumped $15pt in the last two weeks. Profercy’s Nitrogen Index tracked sideways for much of August.

Urea: Supply outages and deferred demand support the market

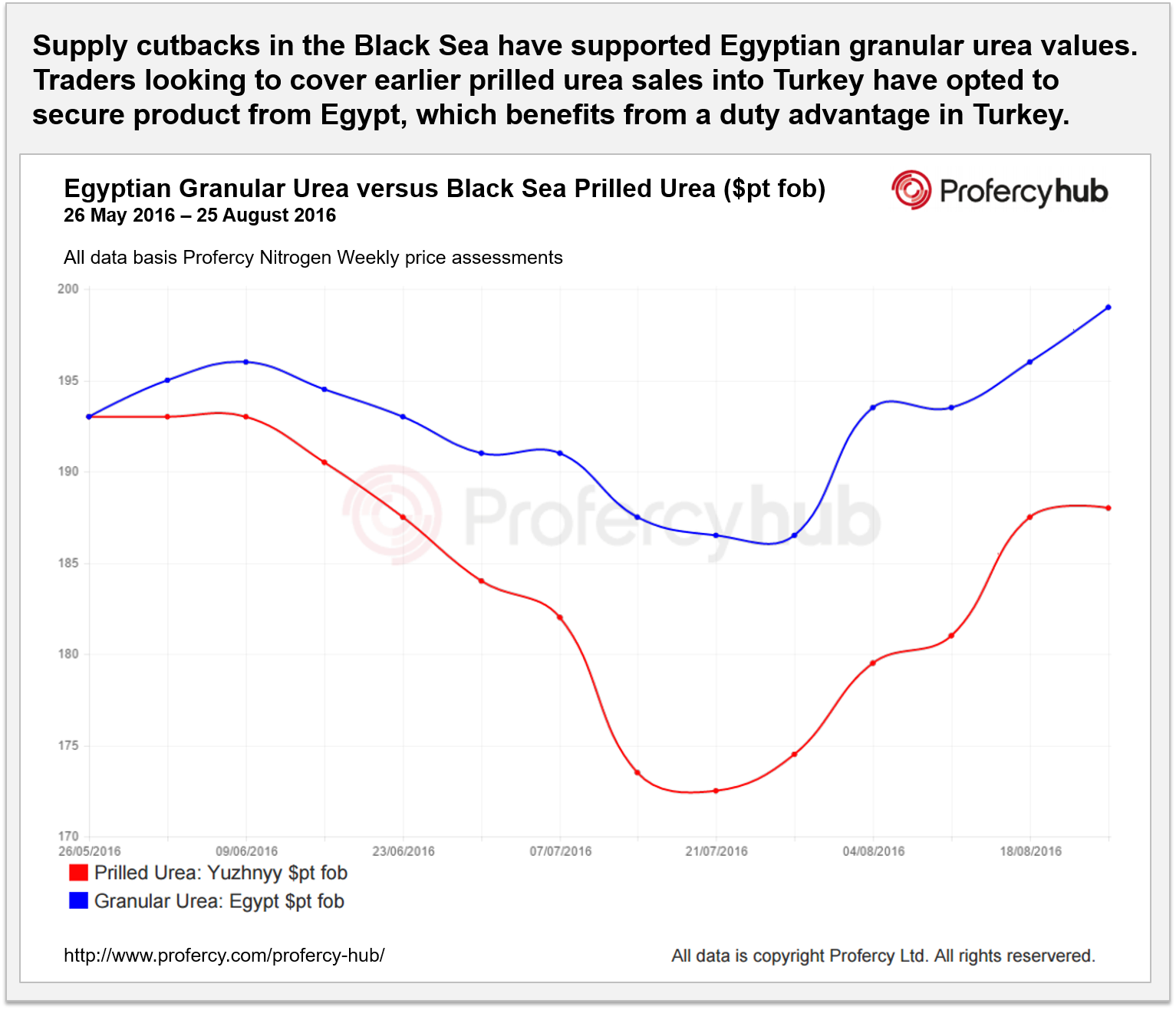

Throughout August the market benefited from supply cutbacks in both the East and West. This included a major facility in Ukraine which suffered from a lack of gas from mid-July leaving Ukrainian prilled urea oversold. Traders were subsequently forced to raise bid levels for remaining stock in the hands of other producers. For those looking to cover sales into Turkey, Egyptian product benefited from a duty advantage and offered a further option. Yet, a number of turnarounds and maintenance of plants in both Egypt and Algeria limited availability and supported sales over $195pt fob by mid- August.

At the same time, Chinese operating rates were responding to the low prices seen in the international market and the end of the domestic season. Operating rates below 65% and a wave of deferred demand in SE Asia and Latin America has helped granular producers maintain prices above $190pt fob. Indeed, Chinese producers felt no need to compete in the early-August Indian tender with all of the business going to traders with Iranian product.

On the back of these supply problems, producers have entered September in a better position than many had anticipated previously. But price stability is beyond the end of September is considered unlikely by many in the market. With many producers in the West due to complete turnarounds shortly and the fallout from supply disruptions waning, buyers in key markets are targeting reductions in anticipation of the October global trade balance being in their favour.

Ammonium Nitrate

International trade of ammonium nitrate was hit in July by the news that the Turkish government had banned imports of the product owing to its potential use as an explosive. Prices fell in slim trade. Mid-August saw a modest reversal of fortunes with FSU producers citing strong domestic demand to secure better prices in Central America. Brazilian buyers are currently receiving offers $15pt higher for imported AN than they had in July.

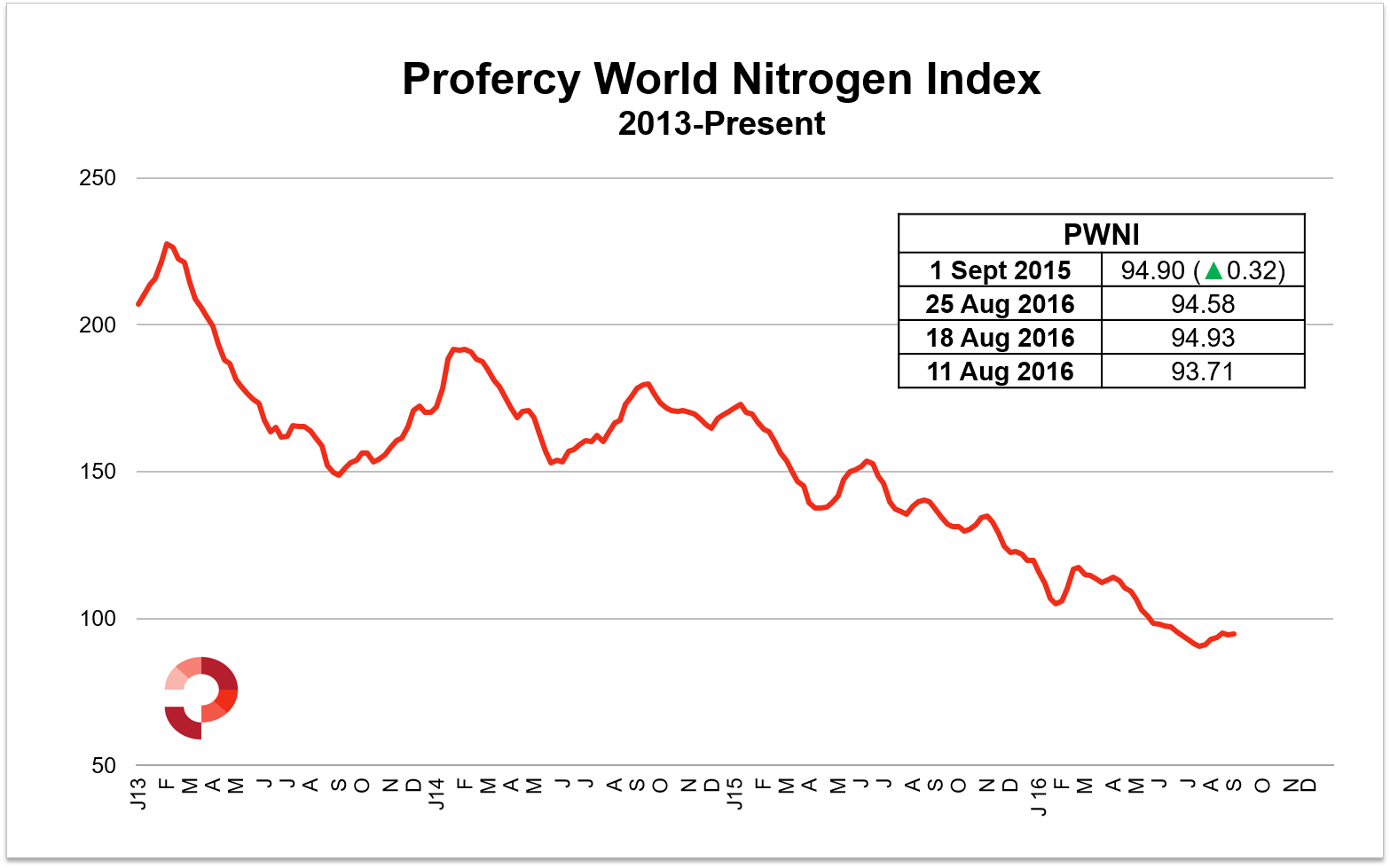

Profercy World Nitrogen Index

Profercy’s World Nitrogen Index began September at just below 95 points, up 4.31 points on the all-time low seen in July. The Index is updated each week here.