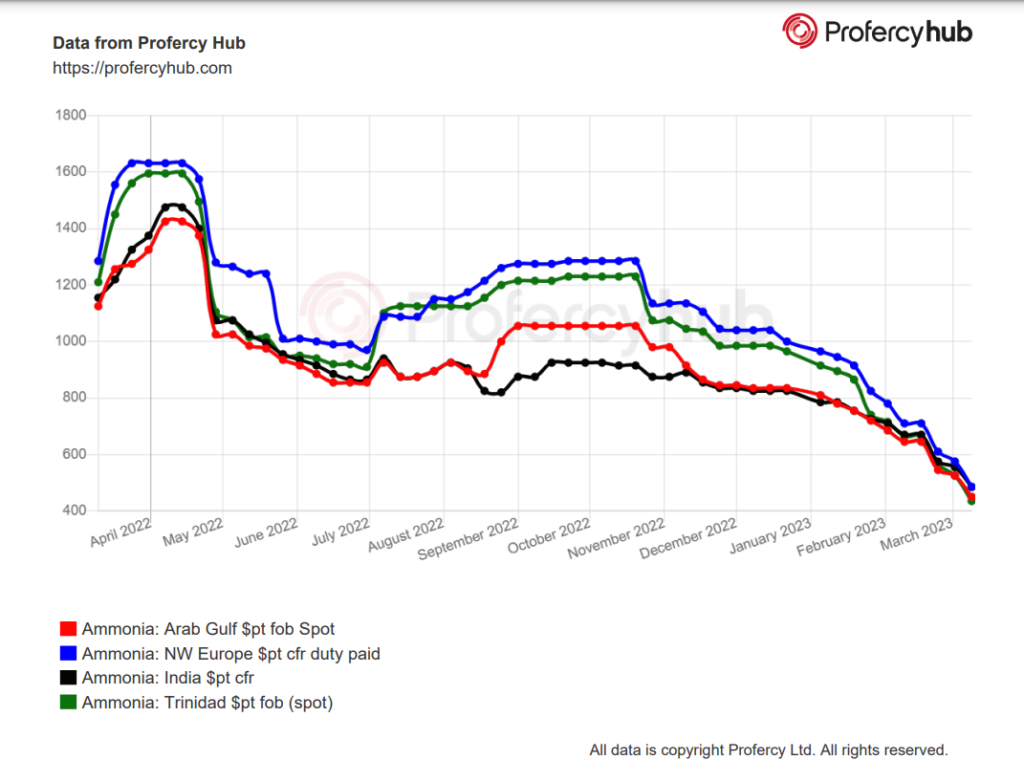

The international ammonia market is falling deeper into bear territory as Q1 draws to a close, with the first confirmed business into Turkey for early April arrival underlining the strong downward pressure that has sparked talk of fresh price corrections.

Trafigura and Trammo both sold into the country in the low-$500s pt cfr, while a third trader missed out on such a sale despite agreeing a figure of $450pt fob for an Algerian cargo.

The former’s sale of 10,000t of Qatari output to a buyer at the Black Sea port of Samsun at $520pt cfr indicates a netback to the Middle East in the low-$400s pt fob.

The picture is just as bleak elsewhere, with producers in North Africa heard considering capacity curtailments due to high inventories, and suggestions that bids of $400pt fob Arzew could be successful given the scale of the surplus.

That would put NW Europe cfr equivalent prices well below $500pt for early Q2 delivery, but buyers at key hubs like Antwerp appear in no rush to acquire volume.

Major players agree another significant price correction is needed if demand is to recover and while suppliers are reluctant to make the first move, they will soon have little choice but to cut price targets considerably.

Amid this pricing stand-off, spot activity remains concentrated on Turkey and India – where Petronas sold 15,000t to at least one recipient for March arrival.

Further evidence of the market length is highlighted by the contraction in the freight market, where yet more vessels have been redelivered or are spending a considerable amount of time at anchorage.

The question facing many suppliers ahead of the dawn of new quarter is whether demand destruction will disappear and import demand rebound to such a degree that it will force a floor to prices.

Bullish sentiment was never going to persist for too long given that plummeting natgas costs in Europe have triggered plant restarts far earlier than originally predicted.

The situation has been somewhat compounded by weak orders from the US farming sector in the wake of unfavourable weather and soft demand from caprolactam (capro) and acrylonitrile (ACN) users in Northeast Asia.

India provided a welcome sales channel for producers East of Suez for a short time, but import demand at ports on both coasts of that country eased in early March amid a notable downturn in contract deliveries.

By Richard Ewing, Head of Ammonia

The latest edition of Profercy’s Ammonia Market Forecast is now available to subscribers. For more information, please contact Richard Johnson on subscriptions@profercy.com