Source: Profercy Nitrogen

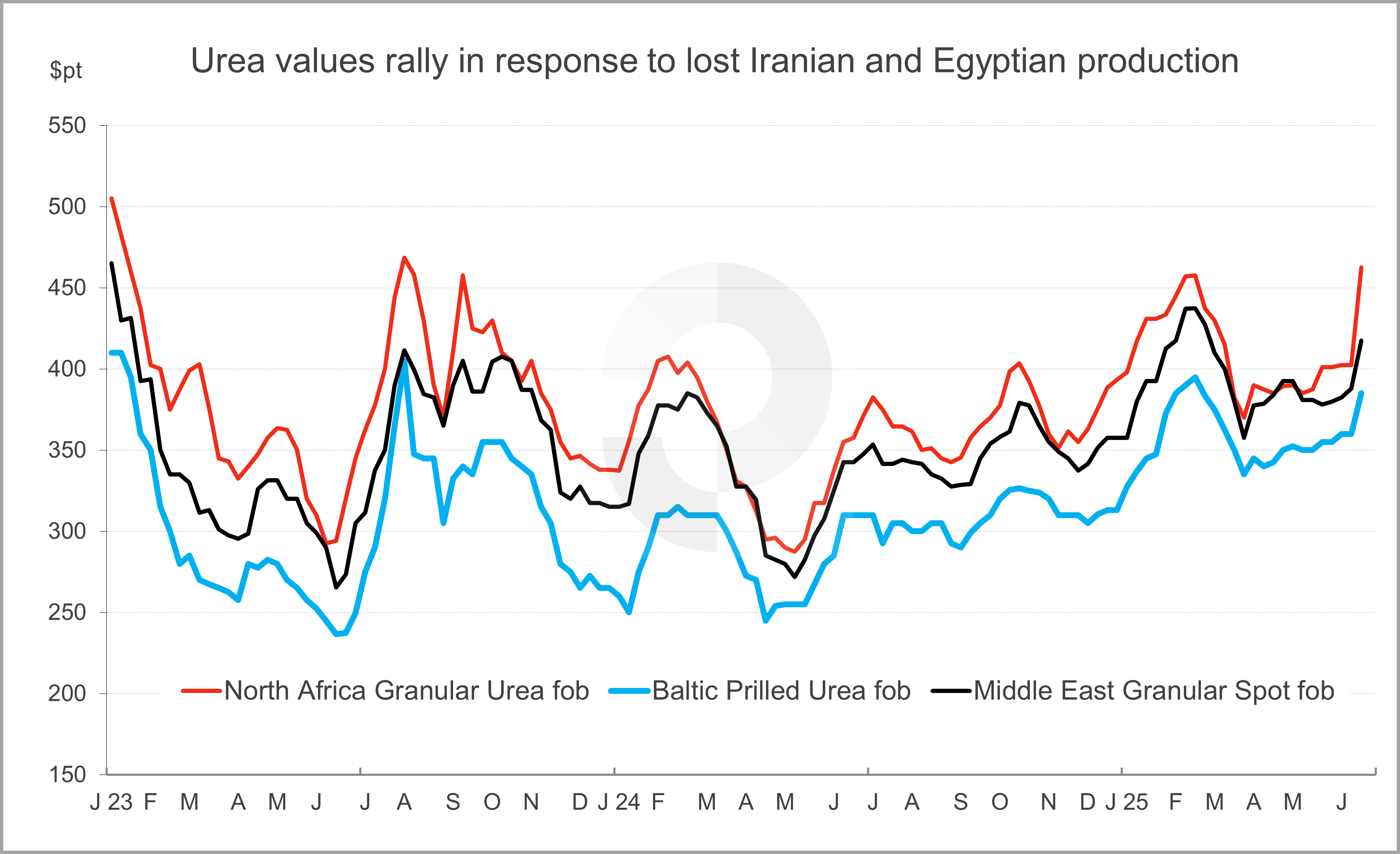

The onset of the Israel-Iran conflict has ushered in a new round of supply cutbacks, spurring a major advance in global urea values.

Few in the market had anticipated such an escalation in tensions, as evidenced by offer levels into recent major urea inquiries and those in many markets late last week.

Global fob values were up 16-25% late in a matter of days as of late yesterday. Most major benchmarks, including those in North Africa and the Middle East, are at levels not seen since end-2022.

Production has been curtailed in Iran while Egyptian producers, amid the wider ongoing energy challenges and the cessation of Israeli gas movements, have lost all feedstock.

Quantifying lost supply

Urea producers in both nations are export-oriented, with the former committing 4.8-5.7m. tonnes/year offshore in 2023-2024, equivalent to 400-475,000t/month. Basis Iranian customs data, 2.34m. tonnes were shipped to Turkey in 2024 and 1.33m. tonnes to Brazil. The picture is muddied by the 667,000t listed against Oman, but that volume undoubtedly moves to other markets rather than the Sultanate.

Egypt exported 4.2-4.6m. tonnes/year across 2022-2023 before well documented gas woes weighed on output with 2024 exports just 2.7m. tonnes basis customs data. The latter reflects below 250,000t/month and was a result of the shutdowns that took place from Q2 into Q3 that year. The lion’s share of Egyptian material is typically directed to Europe, yet Turkey accounted for over 500,000t last year.

Both nations represent a significant portion of global seaborne trade, estimated to be just over 55m. tonnes. Using the 2024 export figures, 144,000t of urea will be lost to the international market every week until the situation improves.

Compounding the global supply woes, drone strikes have also further reduced production at another Russian plant, albeit seemingly temporarily. The attack on the EuroChem plant in Nevinnomyssk follows on from the previous strike on the Novomoskovsk facility, which is understood to be back online soon. The Nevinnomyssk plant managed to operate a few days later, albeit, at a reduced capacity.

European operating rates may be at higher levels than in 2022-2023, but equally Chinese supply is more restrained and at present, there are no signs that Chinese exports will be able to compensate for the lost production and come to the rescue for buyers. Crucially, Indian business remains blocked.

Fob values rally as buyers target alternative supply

Given the extent of the supply situation and with major markets, such as India and Brazil, requiring sizeable volumes in the coming months, nitrogen values have advanced rapidly.

Fob business has dominated with the majority of sales concluded in Algeria and the Middle East. In part, this is due to significant short covering by traders and distributors. Chinese urea has also been offered into Brazil and other Latin American markets, while prills have started to move into Asia.

With regard to recent price gains:

- Baltic granular urea values have advanced from $365pt fob to over $440pt fob in recent tenders, a 20.5% rise from last week.

- Chinese prilled quotes rose from $360pt fob to $395-400pt fob while granular values are up $40-50pt with business concluded in the $430s pt fob.

- North African granular offers were at $410pt fob last week with offers for September now floated at $550pt fob. Algerian producers have sold well over 200,000t for shipment into August at levels up to $536pt fob.

With input costs now in line with those at the end of 2022, buyers are citing affordability concerns, particularly given grain values are well below those of 2022-2023.

However, many concede that markets such as India, where product is booked on government account, are not price sensitive with future business likely setting the tone for other markets.

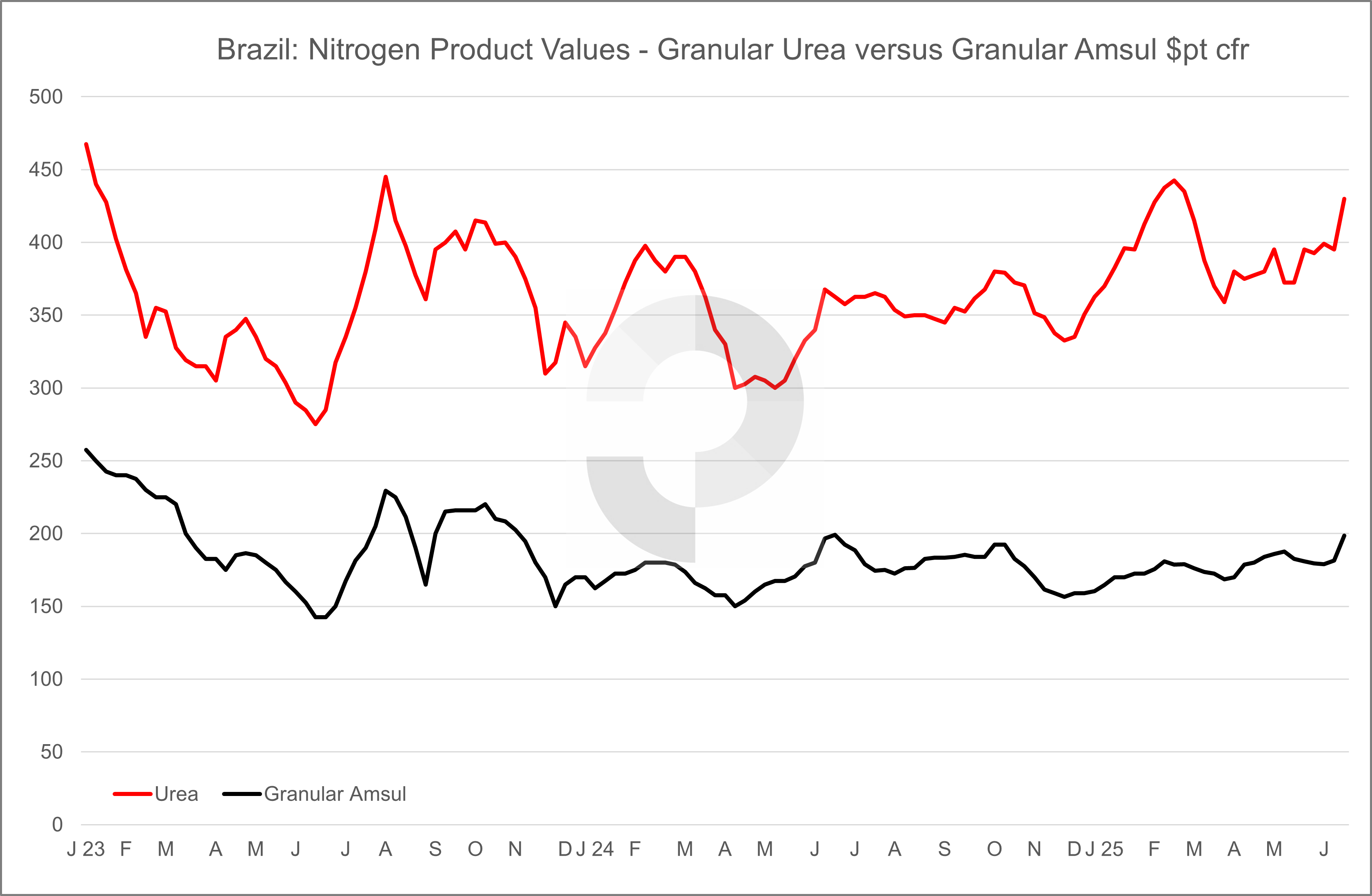

Urea price gains bolsters demand for amsul, AN values moving higher

The sharp gains in the urea markets lifted both amsul and nitrate markets although not to the same degree with regional nuances, namely the end of the Spring season in Europe and the USA, playing a big role.

In Brazil, upwards of 200-250,000t of compacted amsul business was concluded over the last week. The sudden demand, along with increasing urea prices, resulted in amsul values pushing above $200pt cfr for the first time since June 2024. Week on week, prices increased up to $30pt – one of the sharpest weekly gains on record.

The uptick in Brazil supported upstream suppliers in China with both compacted and feedstock capro/steel grade amsul values advancing. Chinese values gained by up to $20pt for both capro and compacted grades.

Source: Profercy Nitrogen

However, the market turbulence and urea price gains did little to stimulate amsul demand in the US with the market unfazed. Local fundamentals trumped the international developments, with wet weather the primary culprit. Seasonality has also played a big factor with Spring demand all but over.

Seasonality has also played a role in the European nitrate market as well, with any product booked now intended for Spring application. Of course, buying must take place in stages throughout the year to guarantee sufficient availability during the next campaign.

Right on the back of the turbulence in the urea markets, major European producers pulled offer levels from the market. Higher nitrate offers from industry majors, including Yara and LAT Nitrogen are anticipated, but buyers do not appear to have panicked with some feeling time is on their side.

Many will be looking to the urea market for guidance, with ex-warehouse quotes from granular urea up to €450-470pt FCA in France by midweek, a hike of €60-80pt in less than a week.

by Chris Yearsley, Head of Nitrogen, Michael Samueli, Daily Nitrogen Editor, and Robert Prendergast, Nitrogen Reporter