Source: Profercy Nitrogen

Fears over capacity curtailments at leading ammonia production hubs in the Americas, North Africa and the Middle East saw the market swing into bull territory this week, though the true extent of the supply squeeze has yet to be confirmed.

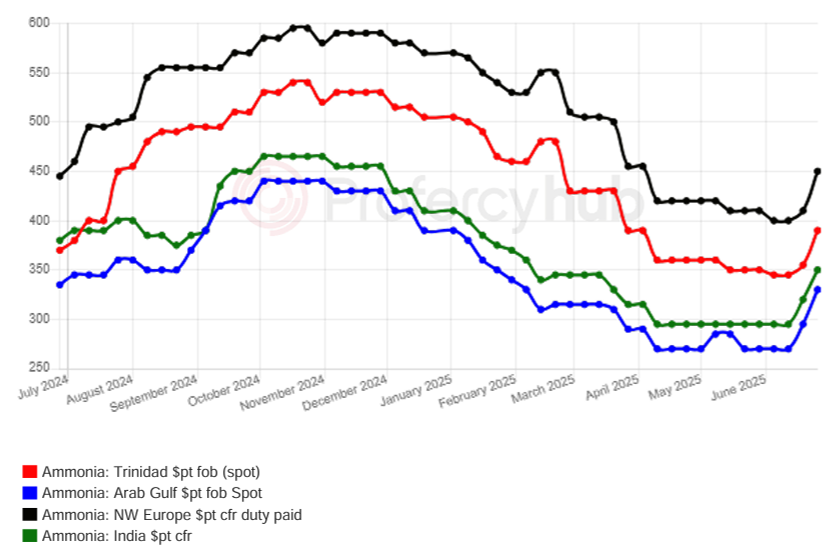

Firmer prices were heard across all regions, with the price rally in the East driven by the loss of Iranian export volumes due to the recent conflict, and the longer-than-expected shutdown at a major plant in Saudi Arabia.

While Iranian material is only shipped to India and Turkey, the country’s January-June exports of 415,000t were up around 30% over the same period of 2024, with 825,000t shipped in total last year, compared to 583,000t in 2023.

Though several plants have now restarted, it will take some time for manufacturers to build sufficient inventory for the next batch of sales, especially as urea production will take priority.

Supply constraints have also emerged in Saudi Arabia due to the extended maintenance at one of Ma’aden’s three 1.1m. tonne/year plants.

Originally due back online next week, that date is understood to have been pushed back to mid-July, a delay that further tightens regional supply against a backdrop of higher insurance costs for tankers passing the Strait of Hormuz.

In Asia Pacific, turnarounds at one or more plants in Indonesia have not had much impact on the market as seasonal demand from major industrial consumers of ammonia across Northeast Asia has been fairly muted, with spot activity limited so far this year.

Bullish sentiment the dominant theme in Europe

The same cannot be said of the market West of Suez, with a shortage of tonnes from Algeria and Egypt prompting large hikes in fob and cfr levels. This bullish trend was also seen in the settlement of the Tampa contract for July, with the US benchmark agreed at $417pt cfr, a $25pt premium to June.

That agreement more than reversed the fall between the May and June settlements and came amid talk of imminent natural gas curtailments in Trinidad – the world’s leading exporter of merchant material – and unexpected capacity constraints in the US Gulf.

While such feedstock restrictions are not unusual for the Caribbean export hub, they often take place later in the year. Although further details of the potential cuts are awaited, major suppliers say they are braced for disruption that could impact shipments to Europe, North Africa, the US and South America.

Higher spot numbers were heard in many of those regions for July business, but with plants in Egypt and Iran – both key suppliers to Turkey – in the process of restarting, demand at a major Moroccan importer reduced for a while, and confirmation of Trinidadian curtailments awaited, the strong upward price momentum could yet run out of steam.

By Richard Ewing, Head of Ammonia/Deputy Editor at Profercy