Source: Profercy Nitrogen

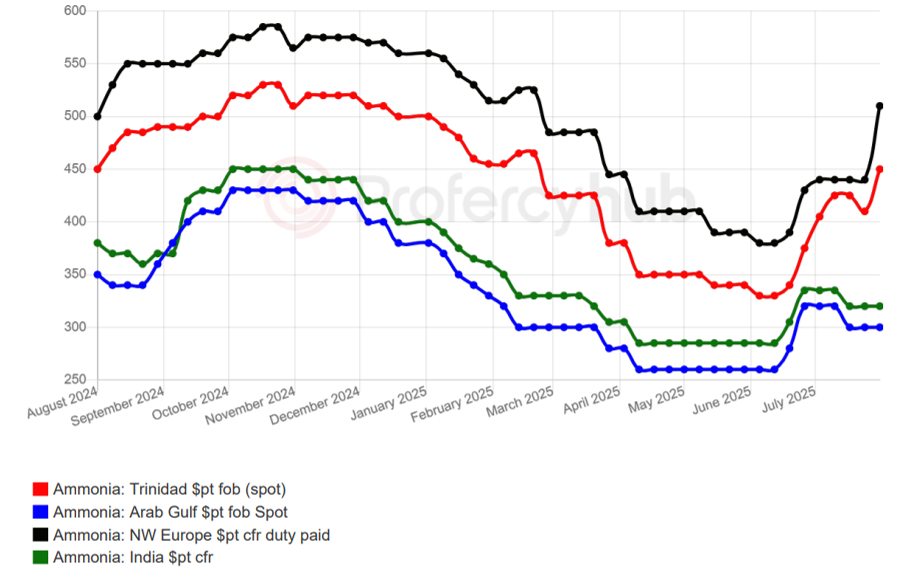

With the market tightening and prices firming West of Suez on persistent capacity constraints in Algeria and Egypt, but the opposite picture seen in the East on plant restarts, arbitrage opportunities have emerged for August and September business.

While access to the Red Sea from the Middle East remains limited to a handful of suppliers, talk is growing of cargoes from the Arabian Gulf possibly heading around the Cape of Good Hope in greater numbers over the coming weeks.

One such cargo was recently sold into the US from Saudi Arabia by a trader and with the market now well supplied in Asia Pacific but balanced to short in the West, some players are mulling sending material to Europe and North Africa from the East.

The bullish tone was reflected in a significant jump in the Tampa contract for August, with the settlement of the US benchmark at $487pt cfr, up $70pt month-on-month, following spot deals in Europe and the US as significant premiums to last done.

While the size of the uplift took some market participants by surprise – particularly in Asia Pacific where conditions remain bearish on strong supply and soft demand – capacity curtailments in North Africa have badly hit traders’ loading schedules.

Such a loss of volume forced one leading player into the spot market at $520pt fob for a 15,000t Turkish cargo for term customers in Spain, with such a delivery usually satisfied by Algerian and Egyptian tonnes.

Several AG cargoes now en route via Red Sea

The lack of North African cargoes has prompted a flurry of shipments from East of Suez for Turkey, with around 75,000t heading up the Red Sea in recent weeks, some of which had been earmarked for India.

However, with Indian spot demand there relatively weak, a 20-24,000t cargo of Iranian volume offered under tender this week may also head to Europe this month.

The supply outlook is brighter in the Americas, where around half a million tonnes of ammonia was loaded at ports in the US Gulf, Caribbean and South America during July, plenty of which has been shipped across the Atlantic to import hubs throughout Europe and North Africa.

Despite the higher prices in such regions, margins on key derivatives such as phosphates and nitrates remain attractive for many ammonia users, though the same is not true of some industrial products, hence the lack of interest in spot cargoes among buyers in Northeast Asia.

By Richard Ewing

Head of Ammonia/Deputy Editor at Profercy