Source: Profercy Nitrogen Service

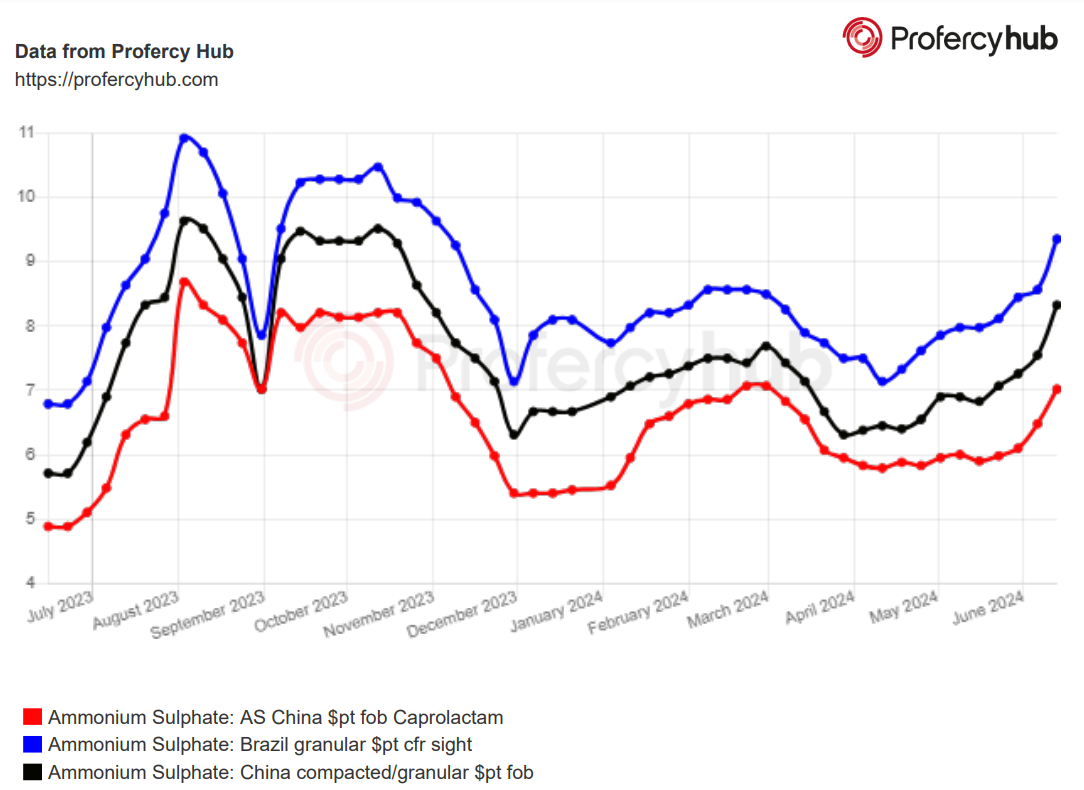

Over the last week, amsul prices have increased by as much as $15-20pt in some regions. While such increases have on occasion taken place in recent years, they are nonetheless quite rare with amsul tending to move no more than $2-5pt at a time on average. The increases bring values to levels not seen since early November.

The increases have largely been sentiment driven with widespread expectations among compacted amsul producers and traders in China that Brazilian demand, along with prices, will pick up for July/August onwards.

This has prompted compacted amsul producers to dive in to secure major volumes of raw material, namely standard capro and steel grade amsul. Prices of raw materials surged higher first on the back of this demand.

In a major test for the market, TCC closed a tender in the Chinese domestic market for 10,000t of capro amsul for August shipment on 13 June. The highest bid for the full volume in the tender was at Rmb 985pt ex-works, equivalent to the high-$140s pt fob. The price was above the minimum/starting price of Rmb 950pt ex-works and around $15pt above the previous week’s values. By comparison, prices have not fluctuated more than $6pt prior to this since mid-March.

The TCC results from the tender strongly reaffirmed the bullish mood in China over the last 1-2 weeks. Indeed, the producer very rarely sells the full volume in its tenders in one bulk lot with container buyers typically taking a portion of availability.

Another positive indicator is the extent of the forward demand with buyers typically booking volume only around 4-6 weeks in advance, whereas the TCC tender was for August shipment.

In the fob markets, some producers including Eversun have been indicating at $150pt fob for next availability in July. Other producers have been indicating up to $160pt fob. The offers have been consistent throughout the week but while they were dismissed by buyers earlier in the week, following the TCC tender, interest improved.

Steel grade amsul values have made similarly sharp price gains, up around Rmb 100pt week on week to Rmb 950-1,000pt ex-works depending on location. The gains narrow the spread between steel and capro grade amsul as compactors step into the market for raw materials.

Nearly all of the capro and steel grade amsul buying in China has been by compactors looking to stock up on raw materials ahead of an anticipated major wave of Brazilian demand for July-August onwards shipments. The expectations are based on lower than typical forward buying in Brazil during Q1 and early Q2 with estimates running at 250-300,000t of business being concluded, around half the volumes booked in recent years.

As such, traders and producers expect an active Q3 with buyers needing to catch up. While this is not guaranteed, the latest price increases in Brazil have only further fuelled the positive sentiment.

Brazil supports Chinese moves

Indeed, following a comparatively quiet start to the week, Brazilian values surged to above $200pt cfr for compacted amsul with up to 15,000t of business concluded at these levels. Earlier in the week, prices were below $190pt cfr while in mid-May they were static at around $170pt cfr. Further still, the latest values are very well above the lows this year seen during mid-April when prices dipped to around $150pt cfr.

The latest sales in Brazil netback to around $175-185pt fob China for compacted amsul, depending on vessel size and discharge ports. These levels in turn are supportive of the latest capro fob prices. Indeed, even earlier in the week, producers were indicating compacted amsul offer levels at $170-180pt fob depending on laycan and producer with 10-15,000t sold for July shipment at $175-180pt fob.

For compactors, an average breakeven spread of $15-20pt is required over capro amsul fob levels for compactors to remain profitable. Basis the latest values in both capro and compacted amsul, the spread is at around $30-35pt. As such, further increases are likely in the coming week to fob price ideas especially for capro/steel grade amsul.

By Michael Samueli, Head of Nitrates and Ammonium Sulphate