Profercy’s latest market forecasts for nitrogen and phosphates markets were published this week. This blog entry provides a brief insight into some of the issues considered. For a free trial of the Profercy Nitrogen Service or the Profercy Phosphates & NPKs Service, please provide your details here.

Nitrogen: Cereal prices front of mind for buyers in the West

As followers of our weekly Nitrogen Index will know, a major price correction has taken place in global urea markets in the last three weeks. As our 3 September Nitrogen Forecast noted “as regards granular urea, a cooling US market for new spot cargoes is expected October/November that could force a correction.” This has taken place with prices for imported product in the US Gulf and Brazil falling significantly since the beginning of September. Naturally, producer netbacks in major export origins, such as the Middle East, have been hit.

Our latest monthly forecast report assesses the prospects for urea markets for the balance of the year and into Q1 2014. Q3 saw a bullish run driven by supply constraints in major export origins, such as Egypt, Ukraine and the Middle East. These are less of a factor in Q4 and while questions remain over production in Ukraine and Egypt, at the moment minds are focused on the demand outlook for urea.

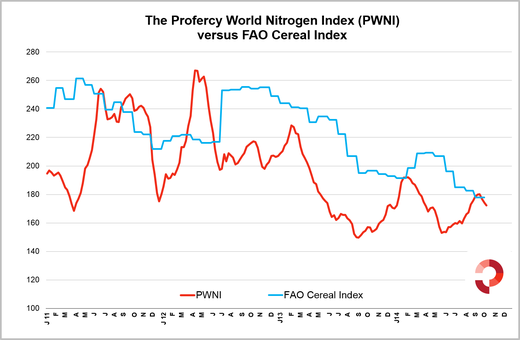

In this respect, cereal prices are a key factor and the long term relationship with Nitrogen is charted below. Indeed, many in the industry are reporting buyer concerns regarding the long-term impact on urea demand in major markets such as Brazil, North America and Europe.

However, at this stage, this should not be overstated as the market approaches the traditionally high-demand Q1. Further, some key export origins have already witnessed significant price falls putting them within reach of last years Q4 average.

Price forecasts and in-depth supply and demand analysis are provided through the Profercy Nitrogen Servic each month. Our latest Forecast report was provided to subscribers earlier this week and included price assessments for all major markets. For a free trial, please click here.

Phosphates: Supply stable, demand volatility expected

Our previous forecast anticipated a peak Tampa DAP at $520pt fob in August, with the market peaking only $5pt short that month. DAP has traded in a narrower range this year, having previously traded in a range of nearly $240pt in previous years. The latest forecast notes that while the supply outlook appears stable, “volatile and opportunistic” demand may bring challenges for the market.

A key factor to watch into 2015 will be the potential for a new export tax policy in China. Many observers expect an end to the use of low and high export tax periods. Buying strategies, particularly for major markets such as India, have been shaped by these windows and will need to adapt to any Chinese policy changes.

Profercy Phosphates latest analysis assesses the prospects for phosphate markets to mid-2015. The report provides detailed analysis on current price trends, forward trade balances for major markets and a detailed price forecast. It is available through the Profercy Phosphates & NPKs Service. To register your interest, please click here.