- CF Industries and Nutrien posted positive results, supported by higher nitrogen values

- Average urea prices in the US are much improved on FH 2017 despite increased US urea capacity, primarily due to lower offshore imports

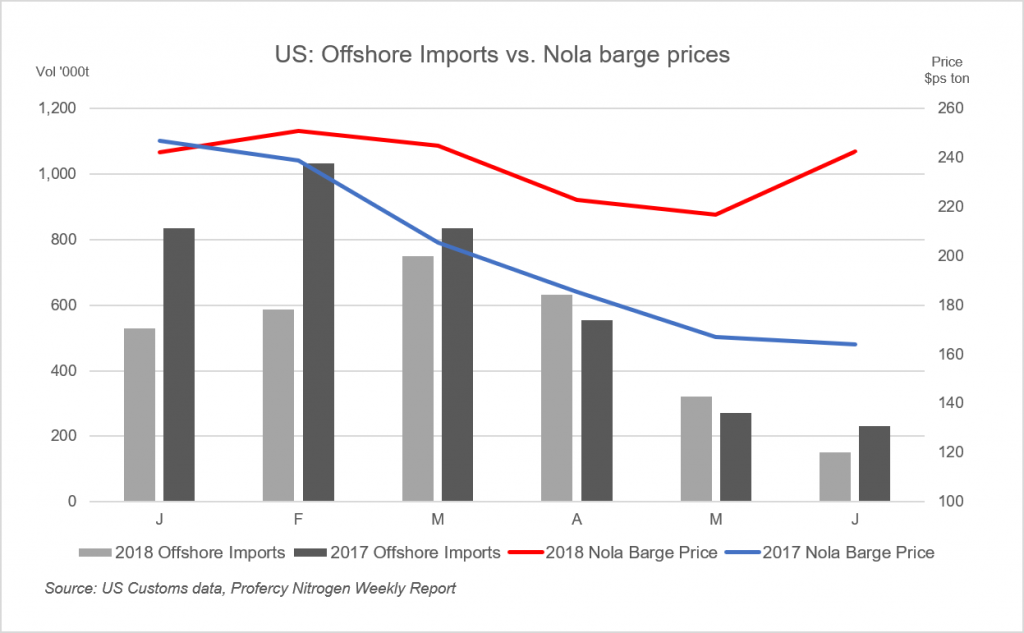

- FH 2018 Nola urea barge prices were around $40ps ton above those in FH 2017

This week both CF Industries and Nutrien posted positive financial results with improved nitrogen values in North America playing a key role. This despite poor weather negatively impacting end-user demand in the US for much of the period.

However, a marked decline in granular urea imports into the US Gulf as well as cheaper feedstock gas prices have lent support to producers.

For CF, first half 2018 sales volumes of urea were just above those in the first half of 2017 with Q2 sales a record 5.5m. tons. Granular urea sales volumes were up in the first half of 2018 at 2.42m. tons versus 2.18m. tons in 2017, primarily due to additional production at Port Neal and higher inventories at the beginning of the year. Nutrien also saw a surge in sales (by volume) in Q2, up 20% year on year to 901,000t, as demand improved with the weather in the middle of Q2. This includes sales of product from Trinidad.

US producers have greatly benefited from the decline in urea imports this year. During the first half of 2017, some 3.7m. tonnes were imported into the US from offshore suppliers leading to an oversupply and weaker prices. Nola urea barge prices dropped to as low as $160ps ton in the middle of the year with monthly average prices falling continuously for six months. This year the import total over the same period is expected to be below 3m. tonnes as Middle Eastern and North African suppliers target other markets. This has resulted in the average first 2018 barge price being roughly $40ps ton above the 2017 average.

China’s decline as an exporter has created new opportunities for Arab Gulf producers in eastern markets and has eased the need to target those in the west.

Increased domestic production, including Koch’s new facility at Enid, Oklahoma, has bridged a large part of the shortfall in imports, but the US market has clearly been more balanced this year.

In addition to the import decline, US producers have been aided by lower costs. Average natural gas costs in CF’s cost of sales were $3.11/mmBtu in first half 2018 versus $3.51/mmBtu the previous year.

Nutrien stated that its cost of goods decreased by 5% to $595million while the gross margin increasing by 33% to $261million in Q2 2018 year on year.

By Michael Samueli