Source: Profercy Nitrogen

Urea export availability from China has played a major role in shaping global market movements in the second half of this year.

Indeed, inspection controls have waxed and waned in tandem with domestic market movements. Most notably, in August and September domestic and international traders faced more onerous CIQ inspections in the wake of 1.1m. tonnes of urea being committed to India and domestic urea prices firming.

Little over 300,000t was committed in the most recent Indian inquiry, requiring shipment by 10 December.

In latest developments, the Chinese Nitrogen Fertilizer Industry Association issued a communique to members today with a three-point action plan centred around maintaining sufficient supplies in the domestic market, as well as keeping domestic prices low. The notice referred to nitrogen but the steps are understood to primarily relate to urea.

The notice refers to a state minimum production plan and the need to organise production and sales of nitrogen fertilizer. It notes that “qualified enterprises must take the initiative to increase production [and] put an end to hoarding and reluctance to sell”.

Further, it addresses domestic prices and calls on producers to take the initiative to reduce domestic price levels.

It goes on to state that ex-works prices will not be higher than the 16 November level ‘from now on’.

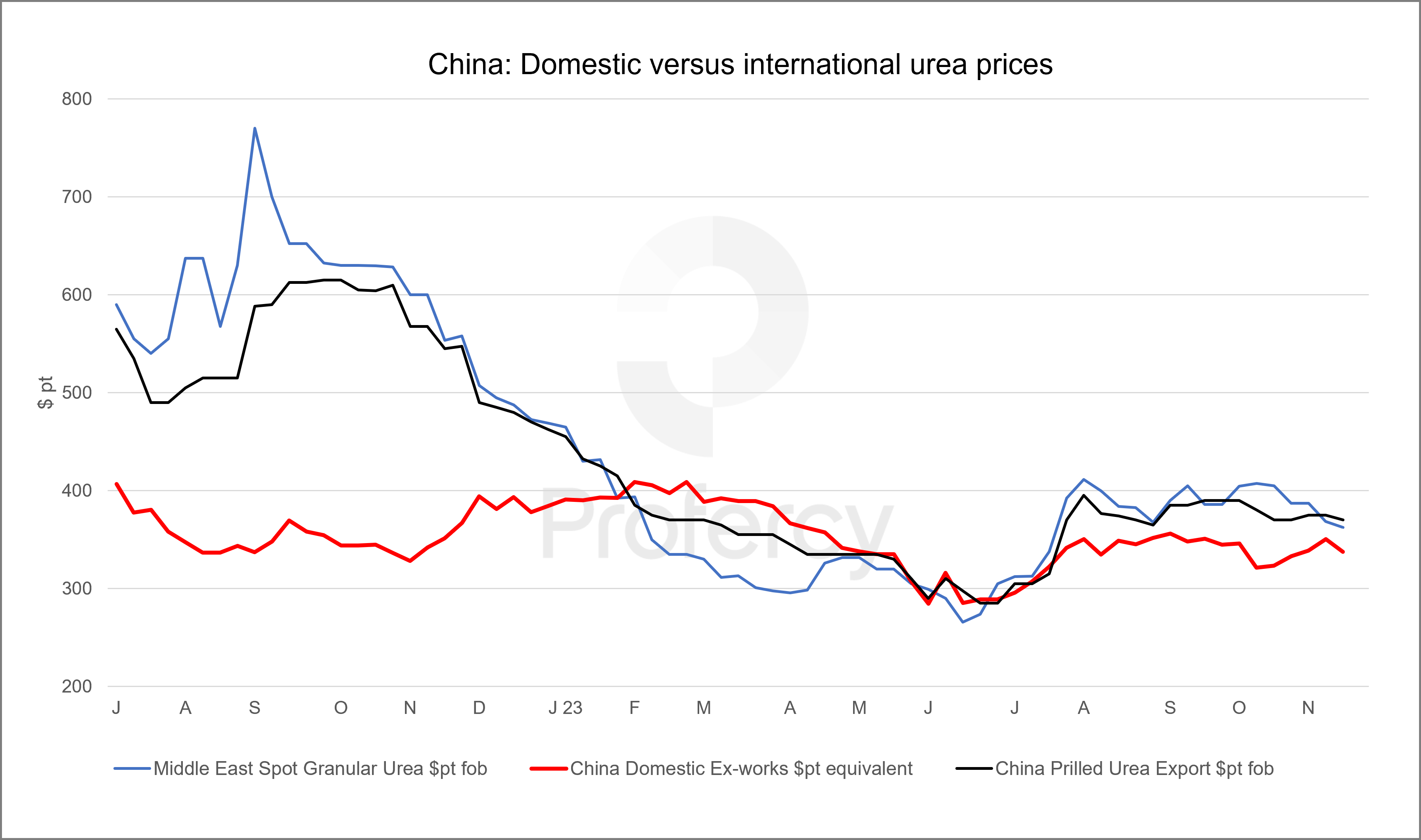

Of note, the latest prilled urea prices in the benchmark Shandong market have been at Rmb 2,440-2,460pt ex-works, equivalent to just under $360pt fob equivalent. Prices have fluctuated around this level in recent weeks having firmed from lows of just over Rmb 2,000pt ex-works in June.

Finally, the notice calls on producers to give priority to domestic supply. The industry body states that all CIQ inspection applications that have been applied for, but not yet issued, will be withdrawn. It also calls for goods en route to the ports or already at port to be withdrawn.

With the above, the association aims to organise the basis for self-regulation of export activities next year while establishing ‘corporate implementation of social policies’.

For now, the latest announcement does not appear to drastically alter the existing status quo. CIQ cleared product available for export in December was minimal. This followed the earlier commitment of 6-7 vessels, representing over 300,000t of prilled urea, to India under the previous IPL tender.

There has been no news that existing export commitments, including commitments to India, have been impacted in any way. Several vessels have already been nominated under this business.

Indeed, the extension of CIQ inspection timings to 60-70 days had already effectively drastically reduced potential export business in December and into January.

Typically, exports slow into Q1 and Q2 as domestic demand builds. Gas diversions, owing to cold weather, also regularly impact overall production rates in China in December/January.

The latest move does of course raise questions over export availability in the first half of 2024. 1m. tonnes were exported in first half 2023, of which 526,000t was shipped in Q1.

This compares to 724,000t in first half 2022 and 302,000t in Q3 2022. Export levels were far higher prior to the introduction of CIQ controls in the final quarter of 2021.

With regard to the impact on the global market, the recent extension to inspection timings has thus far largely gone unnoticed.

India is between tenders and unlikely to require a large volume in a future inquiry. Recent tenders east of Suez, including those in Pakistan and Bangladesh, have not led to awards and saw notable seller interest from producers in Russia, the Middle East and North Africa.

Further, demand in western markets has proved a disappointment to urea producers. Challenging weather has weighed on Brazilian urea demand while European buyers have taken a relaxed approach to offseason purchases.

By Profercy Nitrogen Team