The trade in fertilizer derivatives continues to register considerable growth as highlighted by latest data from CME Group. Cleared volumes of fertilizer contracts settled against Profercy-ICIS prices for January were 445,000t, just below the record 501,500t traded in November 2018. The trade has grown considerably since the clearing house launched contracts in 2011.

Trade in urea-based contracts were the primary focus of activity in both November 2018 and January 2019. The contracts attracting the greatest volumes were related to US Gulf granular urea barge values and Middle East granular urea spot prices.

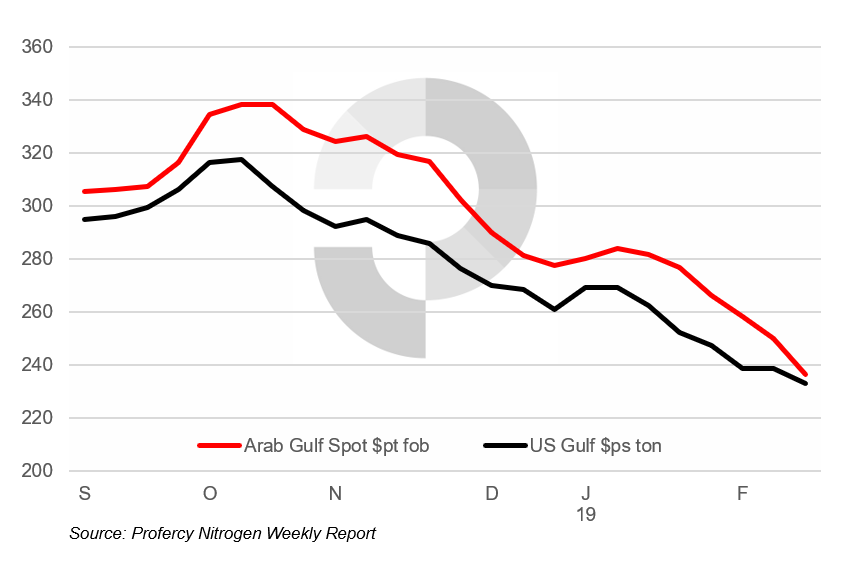

In the physical market, prices in these regions saw considerable volatility in Q4 2018 and into 2019. Middle East prices peaked around $340pt fob in October 2018, bolstered by Indian and Brazilian demand. US Gulf granular urea values rose to $325ps ton fob Nola with supply limited in the Gulf during the off-season.

Global urea values have been under pressure since the middle of January 2019 with Middle East values now $90pt below the October 2018 peak and US Gulf values currently sub-$240ps ton fob Nola ahead of the Spring season in the US.

Note: Settlement prices for the fertilizer derivatives contracts cleared by the CME are tied to the weekly price assessments published by Profercy, via the weekly Profercy Nitrogen and Phosphates & NPKs reports, and ICIS.

Granular Urea: Prices under pressure since October 2018 multi-year highs

More information regarding the trade in fertilizer derivatives can be found via the links listed below.

Chicago Mercantile Exchange: https://www.cmegroup.com/trading/agricultural/fertilizer-swap-futures-fact-card.html

Direct Hedge: https://www.directhedge.com/

Falcon Commodity Markets: https://www.falconcommoditymarkets.com/