Source: Profercy Nitrogen

Lowest offers into the latest National Fertilizers Limited (NFL) tender emerged earlier today with the agency quickly issuing counters to all participants. NFL is targeting urea for shipment by 31 October.

The lowest offers represented a sizeable 536,000t with Ameropa lowest on the east coast at $349.88pt cfr (136,000t) and OQ Trading sharpest on the west coast at $340pt cfr (400,000t). These were in line with market expectations.

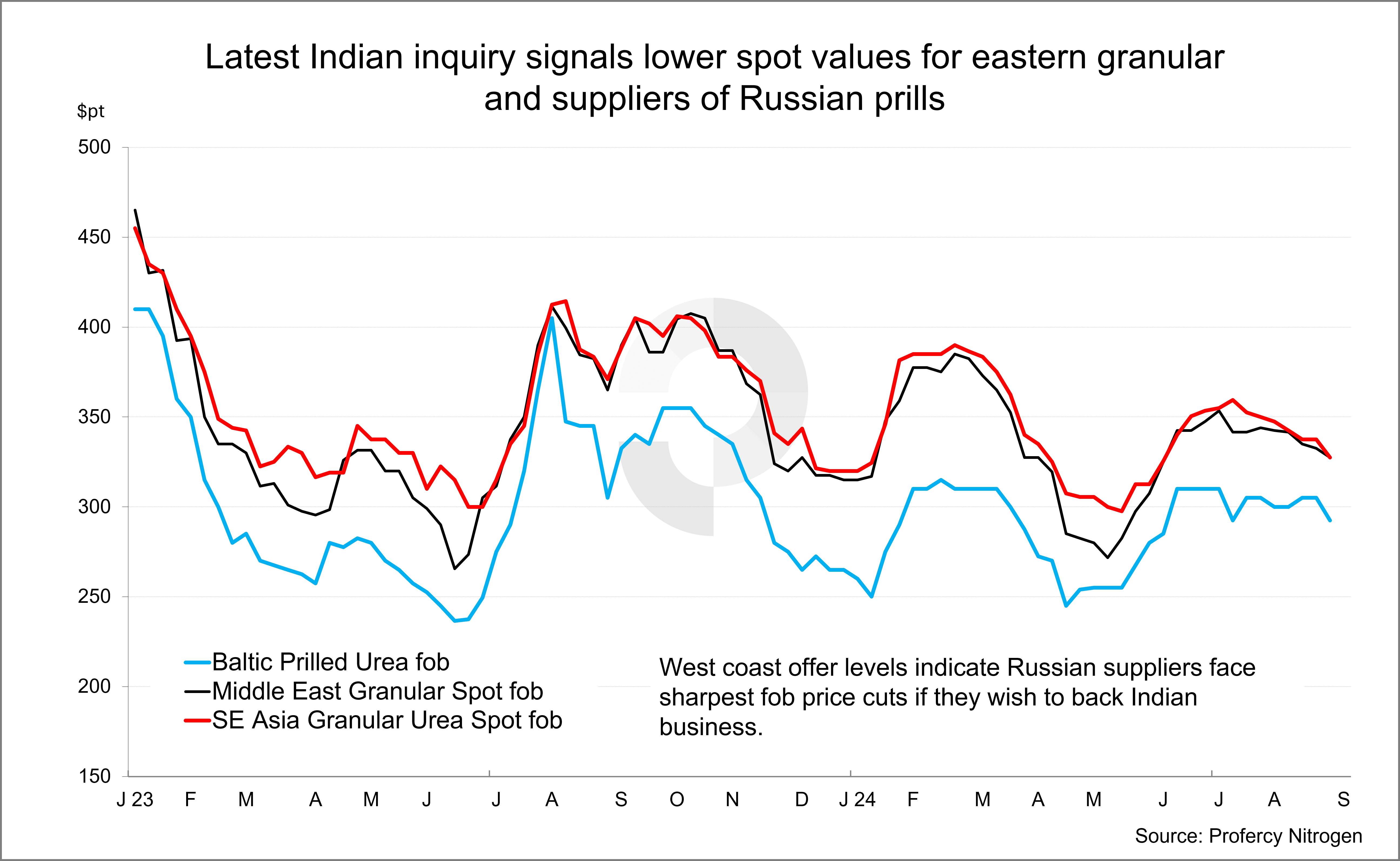

Assuming there are no surprises, implied netbacks point to a near-term consolidation of Middle East spot values around the mid-$320s pt fob.

Indeed, several producers offered direct, as well as many regular suppliers to India from Oman, the UAE, Saudi Arabia, Qatar and Bahrain.

As anticipated, numerous competitive offers were submitted by those also able to ship ex-Baltic.

West and east coast netbacks point to a correction in Russian prilled urea values into the $280s pt fob Baltic.

Prior to the tender, Russian producers had been targeting comfortably over $300pt fob for other markets. Few feel suppliers in the region can skip the business as they had in the earlier 8 July IPL tender.

East coast offers were unsurprisingly at a premium to those into the west. China’s absence – bar the potential for re-export cargoes – has limited eastern supply to material in SE Asia. The slow pace of regional inquiry, and indeed lacklustre Latin American demand, may well encourage granular material from Indonesia and Malaysia into India.

For other markets, it is the volume booked in this latest inquiry that matters. A sizeable purchase of 1m. tonnes or more would leave many eastern producers, and Russian prilled suppliers, comfortable for September and into October.

Other suppliers, primarily those west of Suez, would still need to see a demand-side response from Latin America or markets currently in the offseason in order to build books.

The deadline for confirmations at the NFL counters levels is 16:00 IST tomorrow (4 September).