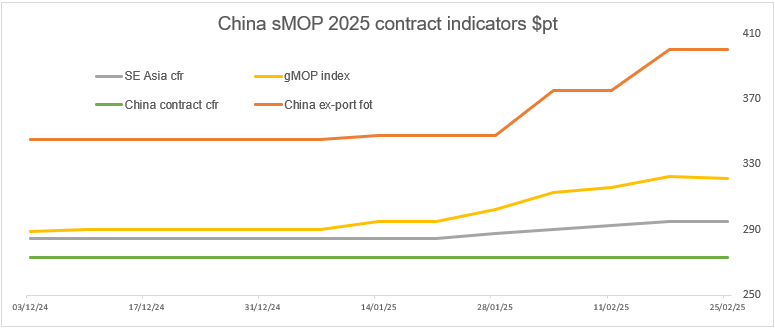

China entered 2025 in a seemingly comfortable position with regards to its potash supply. Overseas producers were continuing to ship 2024 contract volumes to Chinese importers at the price of $273pt cfr and China’s MOP port inventories were reported at a healthy volume of roughly 3Mt at the start of the year, including 1.5Mt of strategic reserves. Domestic MOP prices were also holding stable.

Source: Profercy Potash

However, in the space of just one month, China’s domestic MOP prices have surged more than the equivalent of $50pt to as high as around CNY3,000pt. Multiple factors have combined to force the unusually heavy price increase, including a reported drop of around 500,000t in China’s stocks, demand building for the spring application season, and fears over a significant drop in overseas supply from Belarus and Russia. China’s own domestic MOP production is unable to make up for the shortfall.

Belarusian producer Belaruskali is carrying out large-scale maintenance works to install new equipment at its Soligorsk-4 mine through H1 2025. The repairs began in January and are expected by some sources to take roughly six months to complete, resulting in a production hit of as much as 1Mt. However, ongoing sanctions against Belarus mean that the timescale for these repairs is subject to significant uncertainty.

While this makes it difficult to estimate the production impact of the maintenance, white standard MOP product from Soligorsk-4 is almost entirely shipped to China. As such, Chinese importers are facing a significant decline in their overseas supply. Russia’s Uralkali is also set to undergo maintenance at three mines in Q2-Q3 2025 with the production impact for Q3 indicated by the company at a minimum of 300,000t and the impact for Q3 as yet unclear.

All the above factors will likely draw Chinese potash importers to the table to negotiate 2025 contracts with overseas suppliers sooner rather than later. Profercy subscribers can find more detailed potash market analysis and 2025 China contract expectations in our February Potash Report, which was published on 25 February.

By Logan Collins, Senior Editor – Phosphates, NPKs & Potash