After a challenging Q4, Egyptian producers have capitalised on a wave of short covering and demand for shipments to nearby markets. Over 100,000t of granular urea has been placed in 48 hours with prices rallying more than $30pt.

After a challenging Q4, Egyptian producers have capitalised on a wave of short covering and demand for shipments to nearby markets. Over 100,000t of granular urea has been placed in 48 hours with prices rallying more than $30pt.

At the start of the week, the market was on standby, awaiting news from India regarding the latest purchasing tender. With the exception of Turkey, demand elsewhere had been sluggish, with many North African producers struggling to find liquidity.

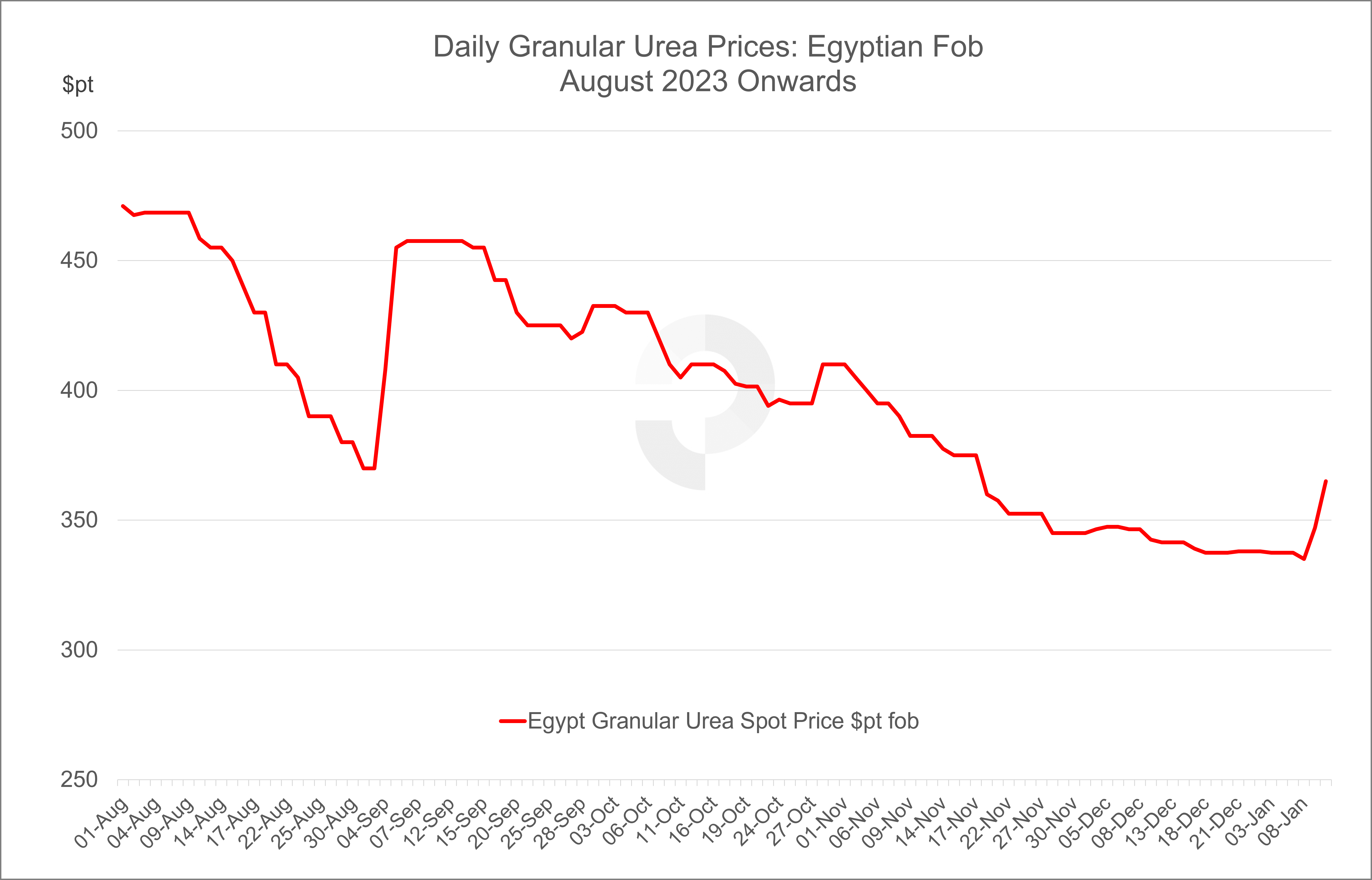

Indeed, the last price rally in Egypt took place in late August and into mid-September when average prices increased from $370pt fob to $455pt fob over the course of two weeks. Since then, nitrogen markets have been in an extended bearish cycle with a few brief and limited upticks.

It appears that few expected the sharp uptick of the last few days. Business began with sales in the mid to high-$330s pt fob on Monday evening (8 January) and has continued near unabated since then with over 100,000t of mostly granular urea, but also prilled urea, being committed for January and into February shipment. All of the reported sales have been for 5-10,000t lots.

Demand from traders looking to cover earlier sales in Turkey, and to a lesser extent, Europe has played a major role. Sales of granular urea into Turkey in mid-December, ahead of seasonal demand, and even into this week were sizeable. Offers were sub-$360pt cfr duty paid in the past seven days, well below current replacement costs.

There has been a moderate uptick in demand in Europe, primarily for eastern and Mediterranean markets. A number of traders are understood to have taken length in anticipation of improved demand in cfr markets. Importantly, North African producers are now in a much more comfortable position for January.

The latest reported sales have been up to $370pt fob with prices having increased by $34pt in less than two days. Of note, the last early September rally saw prices increase by around $85pt before demand cooled.

By Michael Samueli, Daily Nitrogen Editor