Source: Profercy Nitrogen

National Fertilizers Limited (NFL) quickly secured 1.177m. tonnes of urea following the 29 August inquiry for shipments to end-October. As yet the tender has not yet been finalised, with awards pending.

With awards currently widely considered a formality, producers and other suppliers are hopeful the extent of commitments will lend support to the urea market after a sustained period of inactivity.

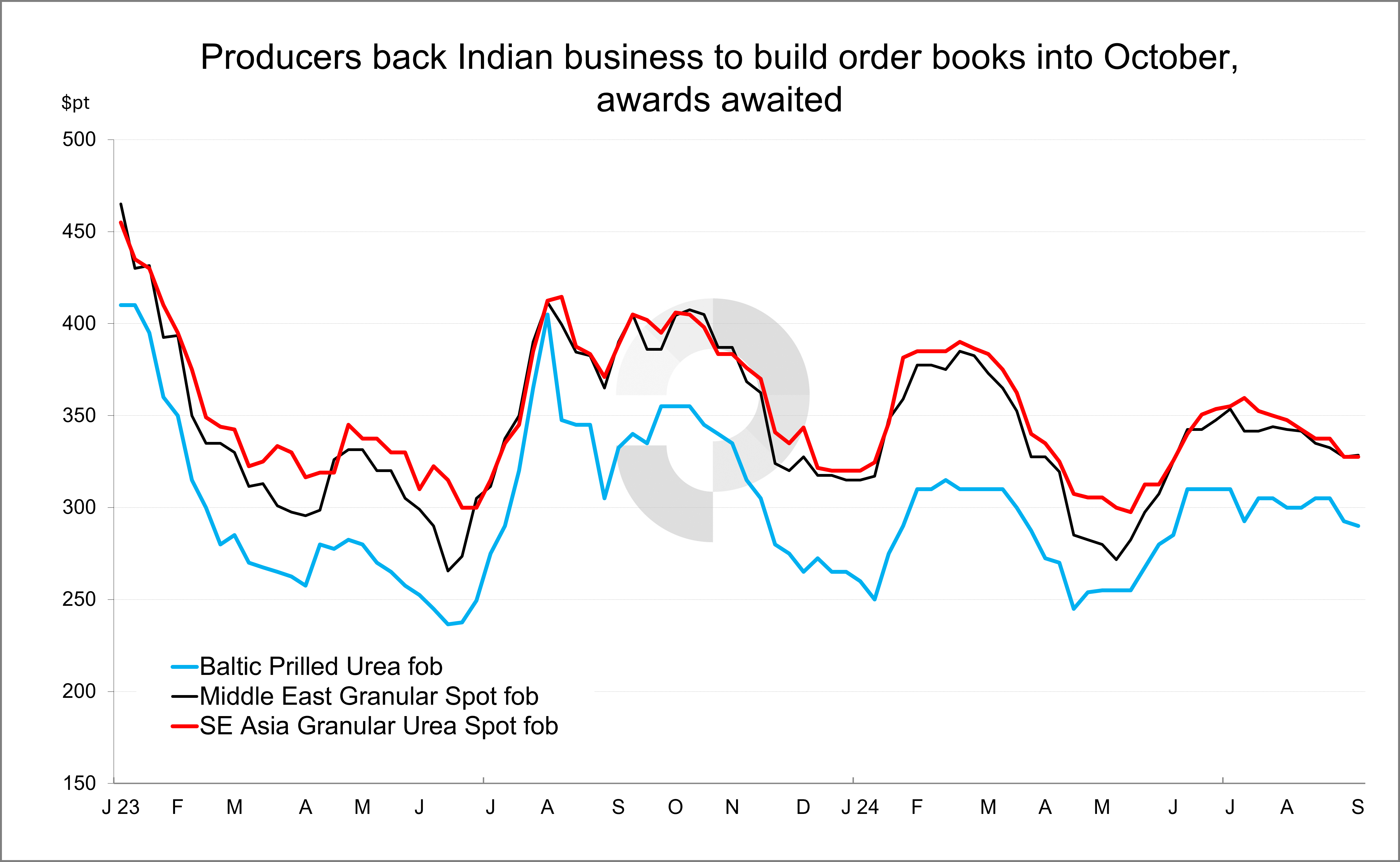

Middle East suppliers appear set to supply over 0.5m. tonnes of urea to India having accepted netbacks in the $320s pt fob up to the low-$330s pt fob depending on coast.

As noted in earlier coverage, Baltic prilled suppliers have been keen with comfortably over 300,000t set to be shipped the tender offering values down to the low-$280s pt fob Baltic. At least one additional cargo of prills from Russia is expected via the Black Sea.

SE Asian material has also been lined up, although volumes have been limited by the absence of Indonesia from the international market of late.

Offers in the tender are to be valid until 13 September, but should the inquiry be finalised as expected, a sizeable portion of spot availability for September into October will have found a home.

Suppliers in the east will be well sold forward, in principle leaving those West of Suez to compete for Latam business, as well as offseason inquiry for Europe.

Derivatives markets reacted quickly to tender developments, but the response from physical markets has been more measured.

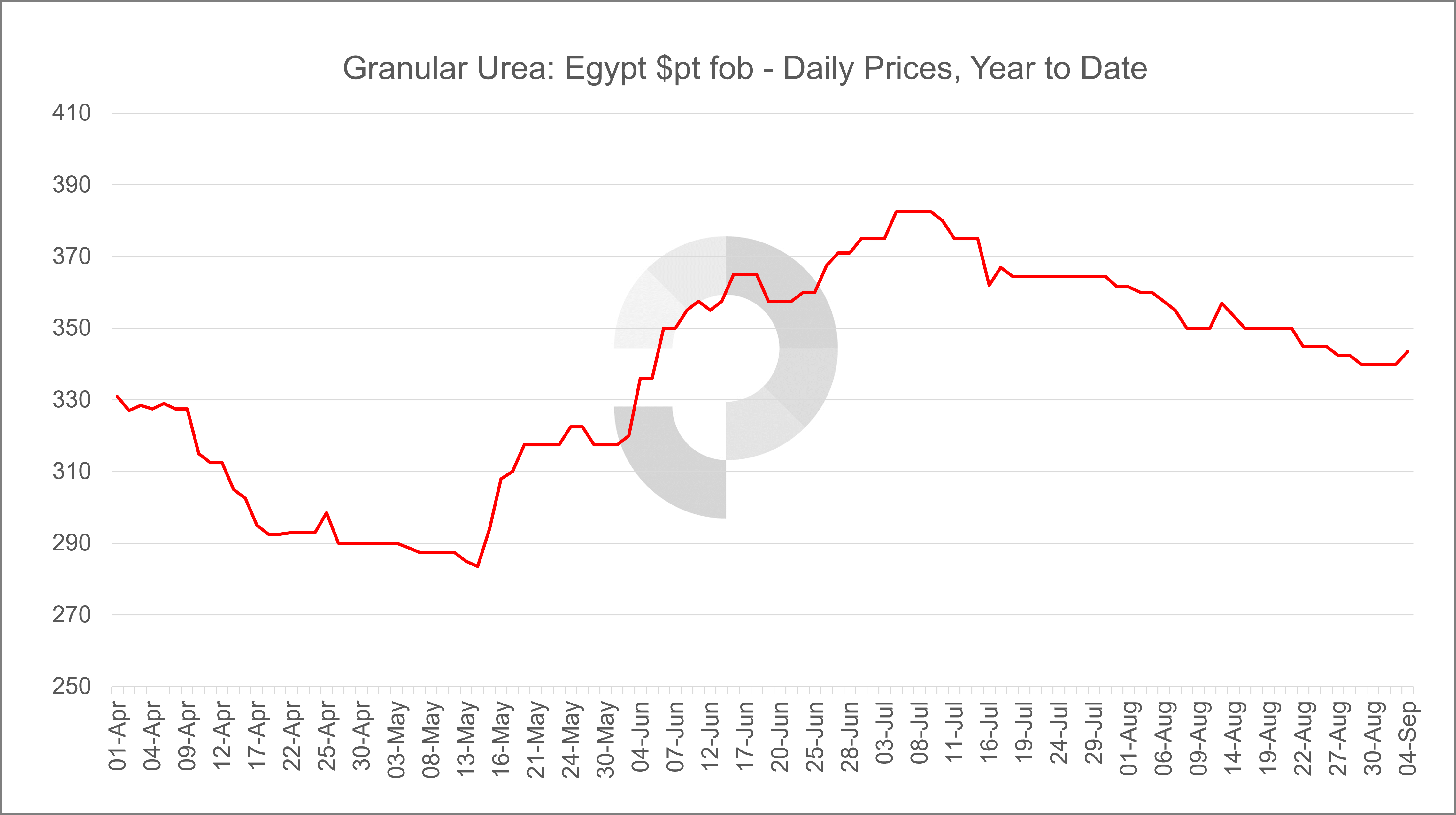

A round of short covering saw around 50,000t of Egyptian granular urea sold for September with values surpassing $350pt fob, a $10pt increase on offers earlier in the week. Prior to the tender, prices had been under pressure for several weeks with traders and European buyers sitting back. Meanwhile, production rates in Egypt remain below capacity.

Russian suppliers also managed to place prilled urea above Indian netback levels midweek with traders stepping in to cover business for Africa and anticipated demand for Latin America.

Brazilian buyers have faced higher offers with the tender spurring some moderate business, although many remain cautious given the extent of imports to date and with the August/September line-up healthy.

In the offseason Nola market, values advanced and broke above $310ps ton fob Nola for the first time since mid-August, reaching $318ps ton fob, a level that put the US market close to parity with Brazil on a cfr basis. Business has since been concluded at marginally lower levels.

Importantly, China has shown no interest in returning to the market with no domestically produced material set to be supplied to India owing to export controls. This is despite the persistent softness in the offseason domestic market which has seen prilled prices fall to their lowest level since early-2021.

There is some renewed optimism amongst global suppliers with the pending Indian purchase thus far considered a success for all parties. Whether the extent of sales will provide a foundation for price gains will largely be a function of demand elsewhere.

After a sustained downward trend, Egyptian granular values firmed through the week with around 50,000t of granular urea booked.

Source: Profercy Nitrogen