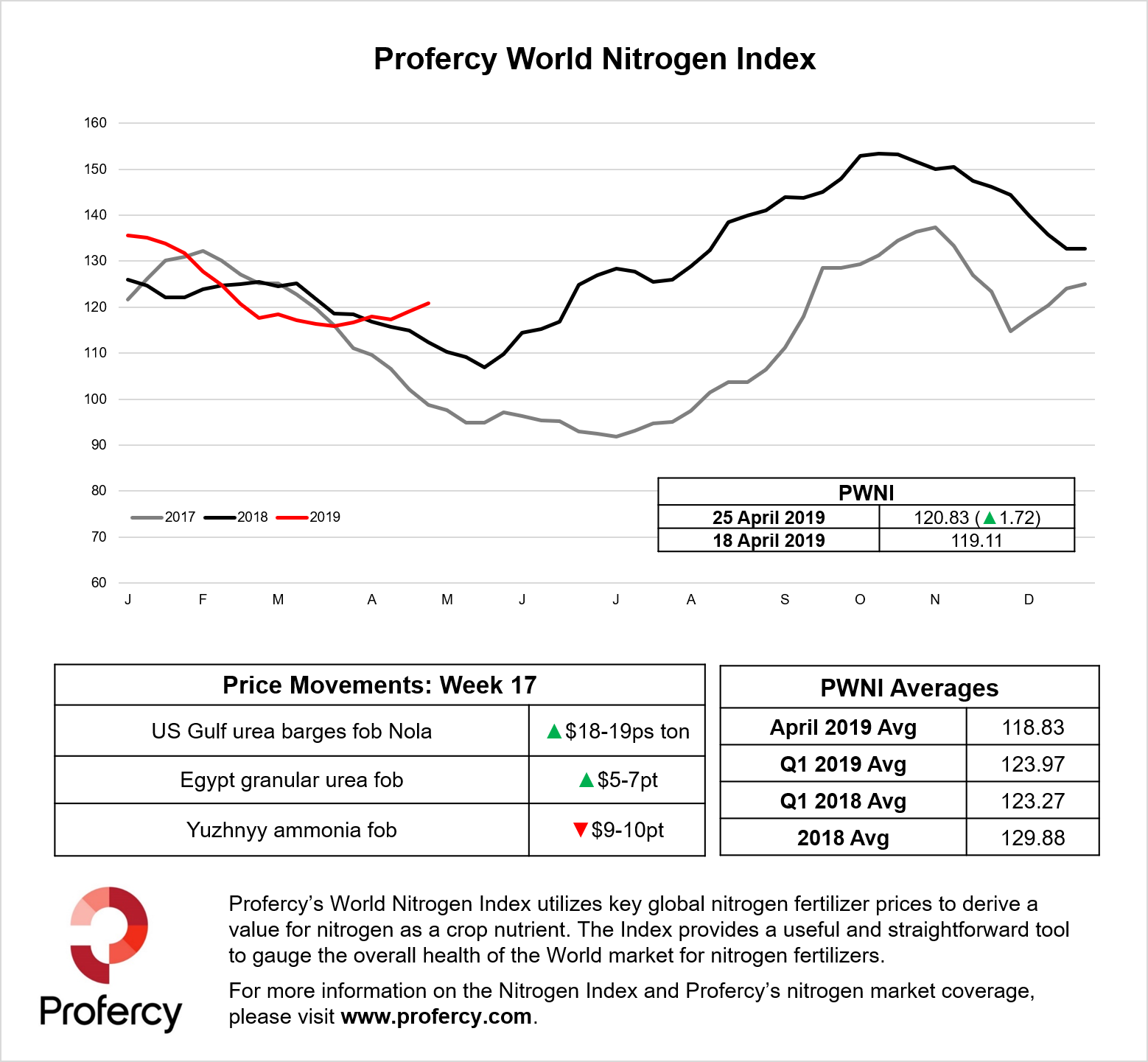

The announcement of a new Indian tender coupled with reaffirmation that US sanctions on Iran will not ease have sparked another sharp increase in urea prices over the past week. Covering in of short sales in India and other Asian markets has added to the inflationary price trend.

In recent weeks producers in the Arab Gulf have been reluctant to place the balance of May shipments in anticipation of Indian subcontinent demand. This was rewarded this week as Middle East spot values advanced by more than $10pt with traders stepping in to book cargoes for both May and June. In the derivatives market, Arab Gulf June and July contracts traded over $275pt fob mid-week. The latest physical values are a marked improvement on the lows seen in March when spot cargoes were booked down to $230pt fob.

As in Q2 2018 Chinese urea is not available to fill the supply gap in Asia with prilled exports not emerging until September last year. This was reflected in a small sale of Chinese product to an Asian market well over $300pt cfr and with Indonesian prilled values also surpassing $260pt fob.

Benefiting from solid returns for shipments to the USA, late demand for Europe and some interest in shipments to the east, Egyptian granular urea prices hit $270pt fob.

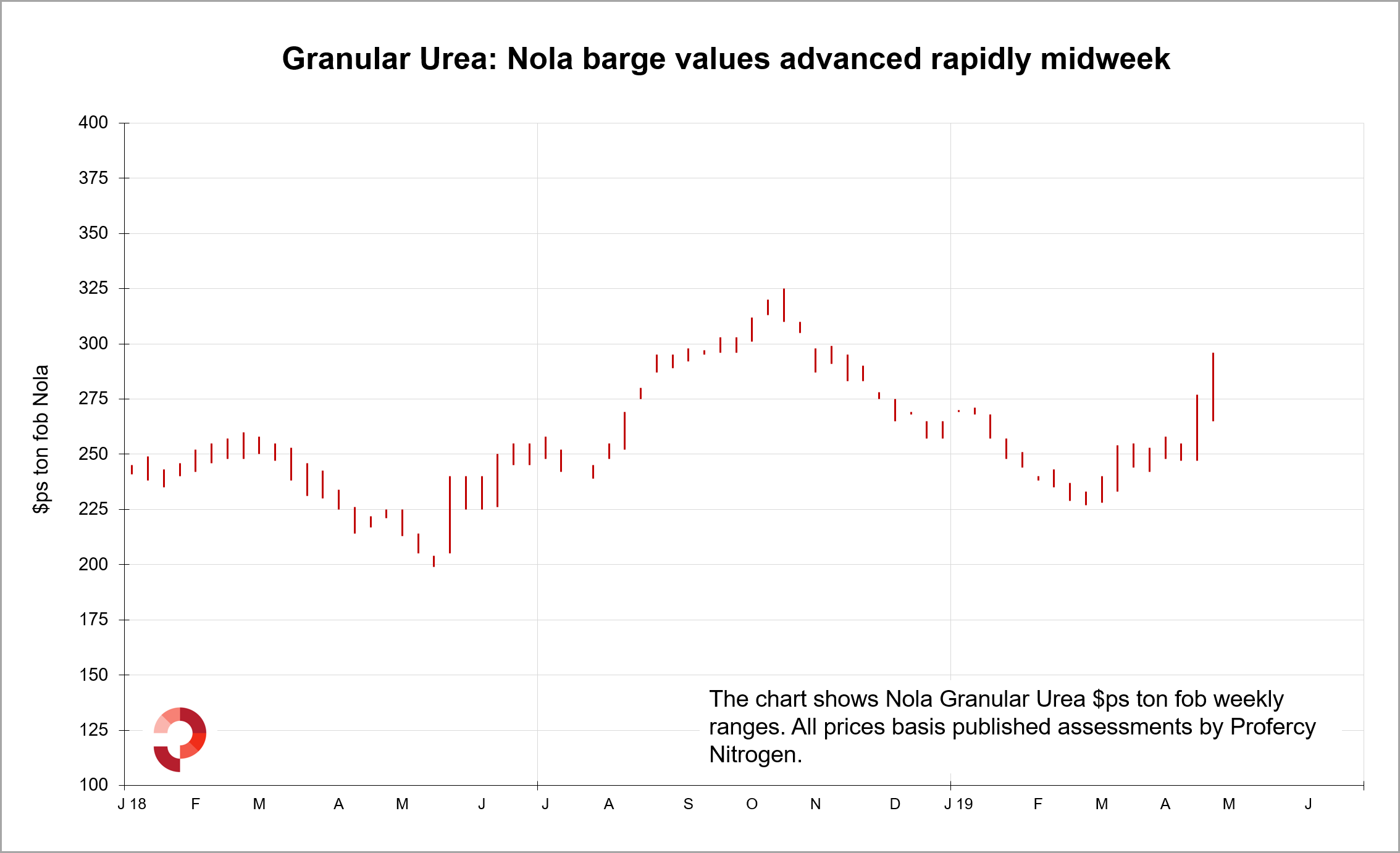

In the USA meanwhile, granular barge prices have surged with a rush for prompt product resulting in around $320pt cfr equivalent being paid (the mid-$290s ps ton fob). With river logistics still causing major delays and blocking movement to northern river locations, terminal prices have also advanced. Indeed, CF Industries has increased offers by as much as $30ps ton for urea from its Port Neal facility.

Brazilian buyers are facing higher offers but have yet to respond. To some extent the position is complicated by the large influx of Iranian product which is being offered at a $35-40pt discount to non-Iranian product. Around 240,000t have been committed from Iran to Brazil in four shipments with the product being marketed by several companies. However, whether this trade will be long-lasting is difficult to assess.

The international market mood is bullish with the next major test on 1 May when MMTC India holds its purchasing tender for urea shipments to 24 June. Iranian urea is officially blocked, while re-export routes from China and elsewhere appear more difficult. As noted above, Chinese suppliers are focused on domestic demand. Hence, if India is targeting a major volume of over 500,000t in its latest purchase, prices will likely need to be attractive to suppliers east and west to secure tonnes.

By Chris Yearsley, Editor, Profercy Nitrogen

E: fertilizers@profercy.com