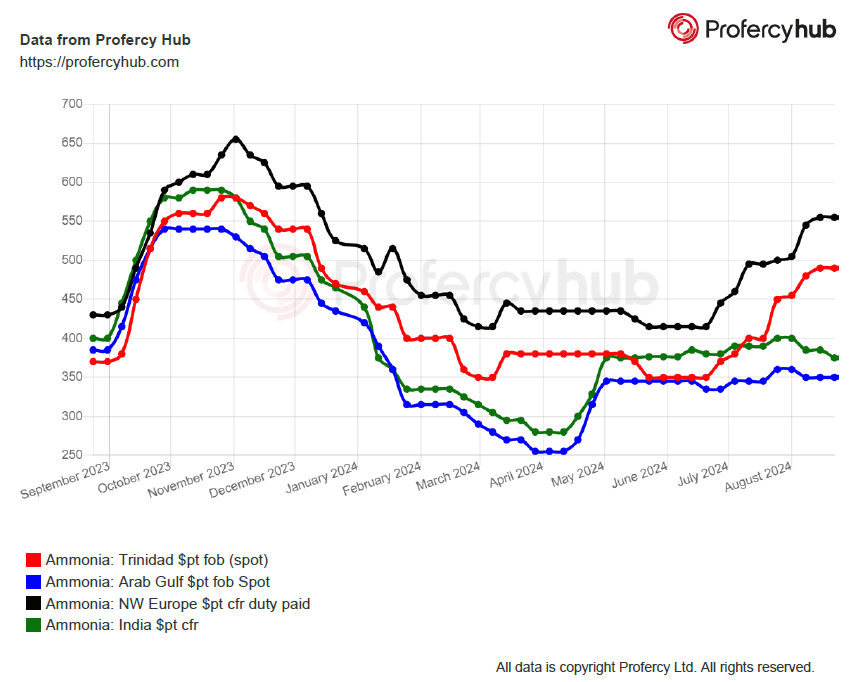

While summer holidays kept many ammonia market players away from their desks, prices, sentiment and the global supply/demand balance remain clearly disjointed between East and West as thoughts turn to September shipments.

While summer holidays kept many ammonia market players away from their desks, prices, sentiment and the global supply/demand balance remain clearly disjointed between East and West as thoughts turn to September shipments.

This trend was illustrated by fresh fob spot business for North African material taking place at a premium to cfr deliveries into the same region.

Thankfully, the confusing picture may not last much longer as export availability from the Caribbean, Algeria and Egypt appears to be returning to normal after months of disruption triggered by feedstock issues.

Such a development should create a downward price trend in the West and bring the market more in line with numbers seen in the East.

Outside of India and Northwest Europe, end user demand in both regions remains soft on seasonal factors.

With many market participants on holiday and the crucial Tampa contract settlement for September loadings yet to appear, spot activity was relatively limited.

Trader Trammo was involved in deals both sides of the Suez, while Algeria’s Sorfert sold up to 30,000t to an unidentified buyer at $530pt fob for prompt lifting from Arzew.

Sales and swaps struck in Southeast Asia

India has been a robust import market of late, but FACT is understood to have scrapped its recent tender for 5-15,000t for 10-25 September delivery to the west coast port of Kochi (Cochin).

The strength of interest in the enquiry was unclear, but the failure to award is understood to be related to the unavailability of phosphoric acid.

In Southeast Asia, Malaysia’s Petronas shifted excess stock by agreeing a swap with Indonesia’s Parna Raya for a 23,500t cargo destined for South Korea.

The pair of producers also agreed a freight deal for a small spot delivery of ex-Sipitang product to a Petronas customer Philphos of the Philippines on a coaster chartered to Parna.

Further north, Trammo is preparing to load the inaugural seaborne parcel from a Chinese producer based near Dalian and deliver it elsewhere in the country before the end of the month.

Meanwhile, despite plenty of talk in recent months of commissioning dates, there is still no sign of any merchant material leaving the new Black Sea transshipment hub of Taman or a long-delayed 1.3m. tonne/year plant in the US Gulf.

By Richard Ewing, Head of Ammonia/Deputy Editor at Profercy