Global nitrogen prices advance rapidly from mid-May; Egyptian and Arab Gulf urea fob prices up $55-70pt

Price rally follows slow start to 2018 as buyers defer demand and weather delays application in the West

Decline in Chinese urea exports hits supply as uncertainty over outlets for Iranian urea continues

Global nitrogen prices gained earlier and faster than anticipated during the second quarter of 2018 as deferred demand and an overall supply reduction on previous years tightened market fundamentals.

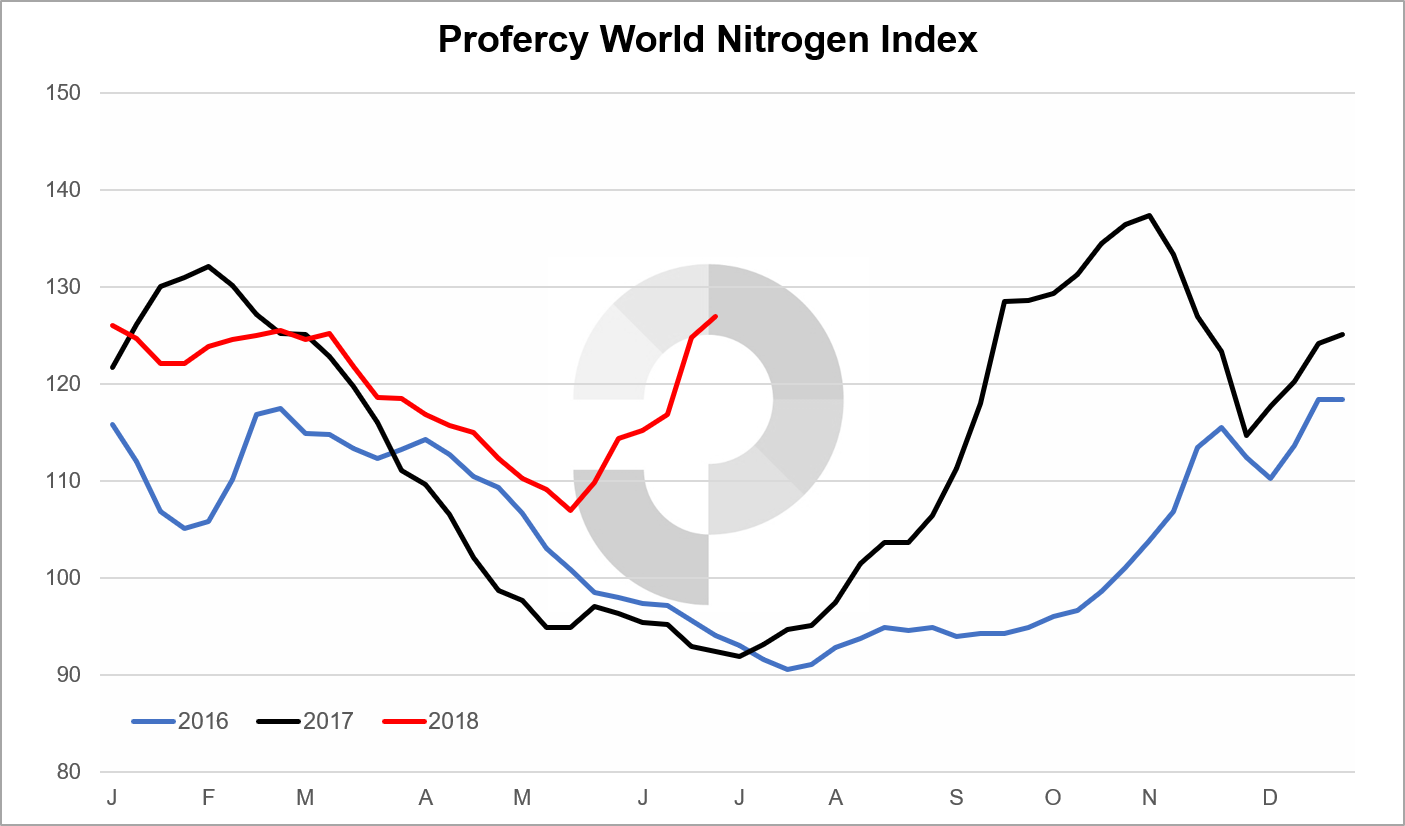

Prior to the market uptick, nitrogen prices had been declining near uninterrupted for 12 weeks. Poor weather in key areas deferred demand and end user application. However, by mid-to-late May the weather had improved, and markets turned dramatically. The Profercy World Nitrogen Index shot up by 7.50 points in two weeks.

In 2017, nitrogen markets did not find a floor until late-June/early July and even when they did, it took 4-5 weeks for the Index to gain by 7.50 points.

Pent-up demand ignites late buying

Nitrogen markets limped into 2018 and by mid-March they were in an obvious protracted decline. Among the main issues was the adverse weather faced in several key markets.

Elongated winters in Europe and the US as well as dry weather in South America delayed a lot of demand and created length in the markets.

Icy waters in the Baltic, which significantly hampered supply logistics, as well as similar problems along the Mississippi River failed to counter the slow pace of demand.

In the Baltic, urea producers started to face inventory pressures, and this led to sharp price declines as they looked to offload product at every opportunity. Several urea producers including Mendeleevsk sold product at ever lower prices and further extended the bearish sentiment.

The urea market found a floor in mid-May just as the weather was fast improving. At the same time, US Gulf prices dipped below the $200ps ton mark for the first and only time in 2018. With demand now surfacing and sensing an opportunity, buyers pilled in and prices shot up by as much as $36ps ton in one week.

Sensing floor prices for the year were evident, buyers and traders were stepping in around the world. Brazilian importers booked sizeable volumes around $250pt cfr having previously targeted much lower levels while over 100,000t of FSU prilled urea was booked for shipment to China. Egyptian producers committed over 200,000t of urea on a spot basis in the final two weeks of May.

Traders step in with longs: urea prices advance rapidly in June

As the market began to turn bullish traders stepped in en-masse and markets began to climb. Within two weeks, the PWNI had gained 7.50 points followed by two more weeks of modest gains before surging by another 10.17 points in the final two weeks of June.

Egyptian producers led the way in the second round of rising prices, which coincided with a major industry conference. Arab Gulf producers with available spot product followed suit with spot sales concluded up to $280pt fob, some $55-60pt above mid-May values.

With producers selling ever higher levels to global traders, regional buyers faced the options of accepting the higher prices and buying or deferred to a later date in anticipation of lower levels.

Soon it became apparent that buyers in Brazil were willing to accept the, continually rising, lower-end of the price ranges. Indeed, this week business has been reported in Brazil at $300pt cfr. Some European buyers also accepted higher prices.

Shortly after that, other buyers in Latin America and elsewhere were buying volumes from traders at the higher levels.

Currently, the single biggest cause for caution is the rate and speed at which prices are increasing, far higher and quicker than in previous years.

China exit leads to higher prices

Not everything in the first half of 2018 was surprising. Profercy’s longer term supply and demand outlooks had correctly predicted a higher price floor for urea in 2018 along with higher average prices.

In first half 2018, the PWNI, at 119.11 points, averaged 7.87 points above first half 2017.

However, the differences between 2018 and 2017 were most evident during Q2. In 2018, the quarter averaged 16.95 points higher at 114.94 points. The low for the first half of both years was in Q2.

In 2017, markets continued to decline all the way through to the end of Q2 to hit a low of 92.44 points. In 2018, the low came six weeks before the end of Q2 and at 106.93 points, 14.49 points above the H1 2017 low.

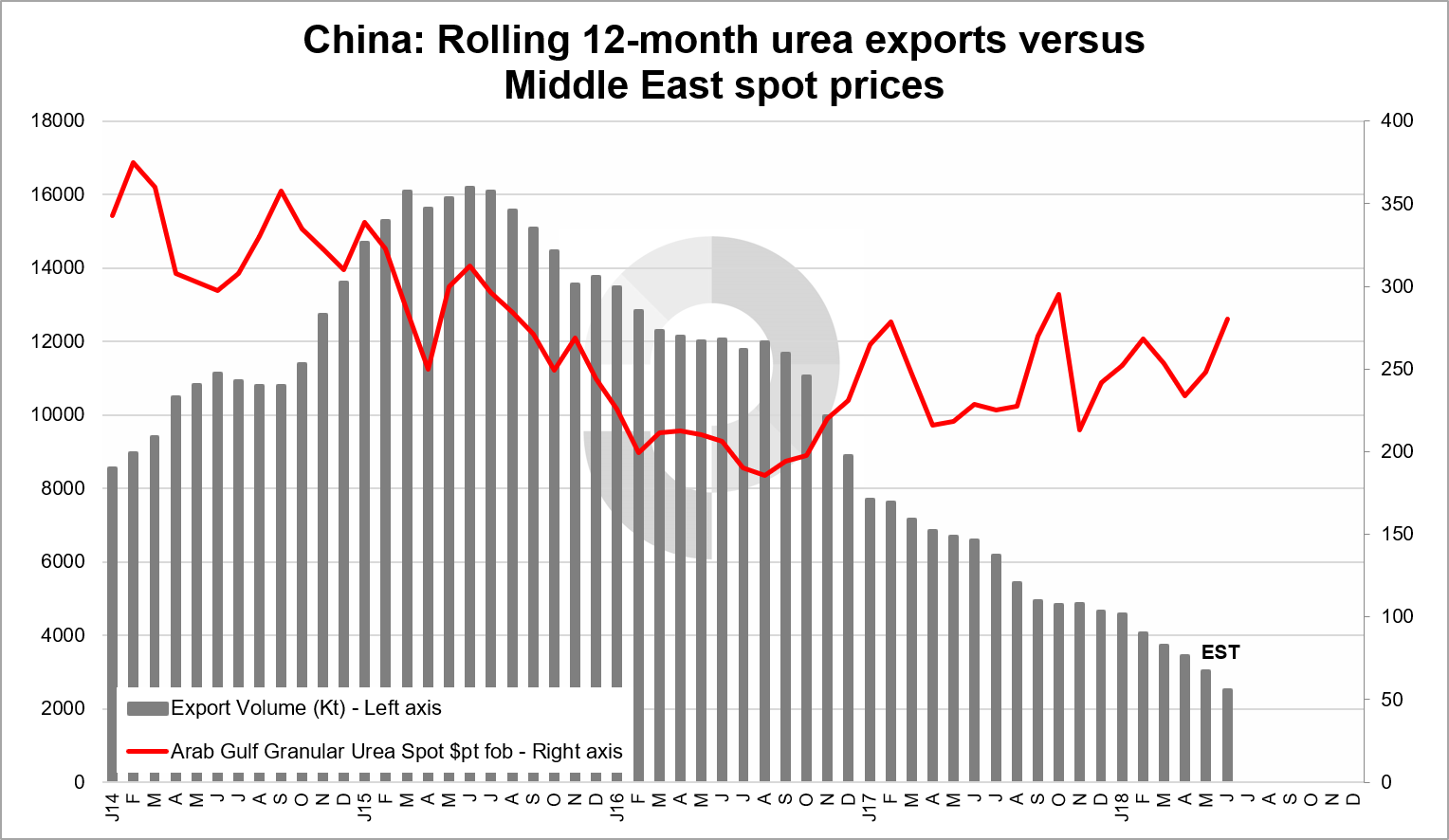

By far the most significant reason behind the firmer markets in 2018 has been China’s diminishing role in the international export markets. As China stepped away, those that relied on Chinese exports, especially those in Asia, were forced to look elsewhere for product.

Arab Gulf countries, due to their geographic advantage, were among the main beneficiaries. Urea producers are now exporting higher volumes to Eastern markets and thereby removing supply from Western markets.

Iran sanctions bite, India still an outlet?

In addition to China, there is uncertainty over Iran’s ability to export product due to the country facing renewed US sanctions. While authorities in several markets, including the European Union, India and Turkey, have stated that they will continue to trade with India, banking systems, with exposure to the US dollar and US markets, have been hesitant to run the risk of falling foul of US sanctions.

The current price run has taken place without an India urea purchasing tender, the last of which bought over 1.1m. tonnes. Even with Iran able to export, a sizeable Indian tender is most likely to add to the bullish sentiment and send markets higher.

A small Indian tender designed to purchase Iranian material at a lower price will not have a negative impact and will be largely ignored by the markets.

However, if India is not able to buy from Iran and is forced to look elsewhere for supply then prices are likely to spike further to multi-year highs and lead to supply shortages throughout 2018.

Authors: Michael Samueli, Clive Yearsley. To contact the authors, please use the Contact Us section.