Source: Profercy Nitrogen

India’s surprise early-return has ended the malaise that had emerged in many areas of the market. News of the tender midweek spurred a round of fob activity in the east and west with Profercy’s Nitrogen Index subsequently advancing a further 2.63 points. The Index stands at 162.11, returning above 160 points for the first time since March.

Rashtriya Chemicals and Fertilizers (RCF) will now close a purchasing tender on 3 October with shipments by 20 November sought.

Abnormally, the tender comes just weeks after NFL secured over 1.12m. tonnes for shipment by 31 October.

Overlapping shipment windows in such tenders are a rare occurrence with the latest move set to benefit regular suppliers in Russia and the Middle East. Many already have solid commitments to India that extend well into October.

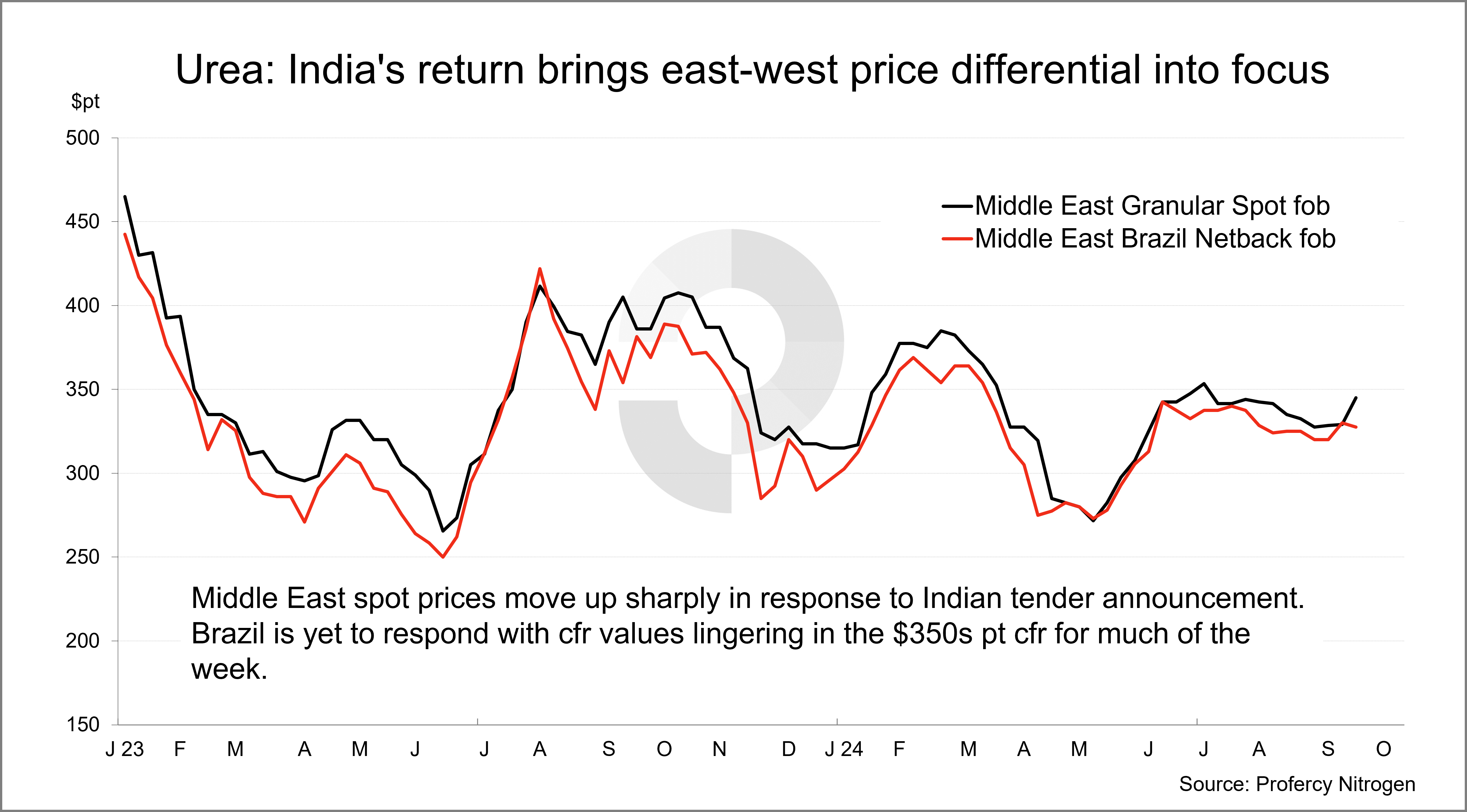

Unsurprisingly, the news spurred higher values in the east with an end-October/early-November Middle East vessel booked at $350pt fob. Bid interest had been at least $10pt lower earlier in the week.

The latest Indonesian granular urea sales tender, the first since July, has seen valid bids for a 30-45,000t lot around $355pt fob. Bids had edged up to the high-$330s pt fob SE Asia for small volumes earlier in the week.

Earlier Egyptian gas woes insufficient to boost fob activity

Prior to the news, the market had been relatively dormant. Despite a further round of short-lived gas cuts in Egypt that halted production at several units for 3-4 days, traders and European buyers had sat back.

The emergence of Indian inquiry, as well as expectations for maintenance works affecting some Algerian producers, encouraged a round of purchasing in the low to mid-$360s pt fob Egypt. Unsurprisingly, European buyers saw offer levels advance rapidly with many suppliers targeting well over $390pt cfr for fresh shipments to key markets, such as France.

All eyes are now on how buyers in Latin America, primarily Brazil, will respond. A significant round of farm level purchasing in Brazil is anticipated, yet spot import business has been light and arrivals steady. Offers for much of the week had been around $355pt cfr, with small volume sales done at lower values. With India out, many lifted offers into the $360s pt cfr or pulled them entirely.

Returning to the east, China has shown no sign of returning to the international stage. Yet, with production rates soaring to over 195,000t/day and domestic values lower, speculation persists as to whether stock levels will build to levels that will result in exports being permitted. A near-term change exports controls that would allow business for India is considered unlikely.

By Chris Yearsley, Nitrogen Editor

The above article draws on the news and analysis published in the 19 September Profercy Nitrogen Weekly Report.