- US barge values stable at TFI Annual Conference following $30ps ton drop since early January

- US still offers best returns for product arriving from the Arab Gulf

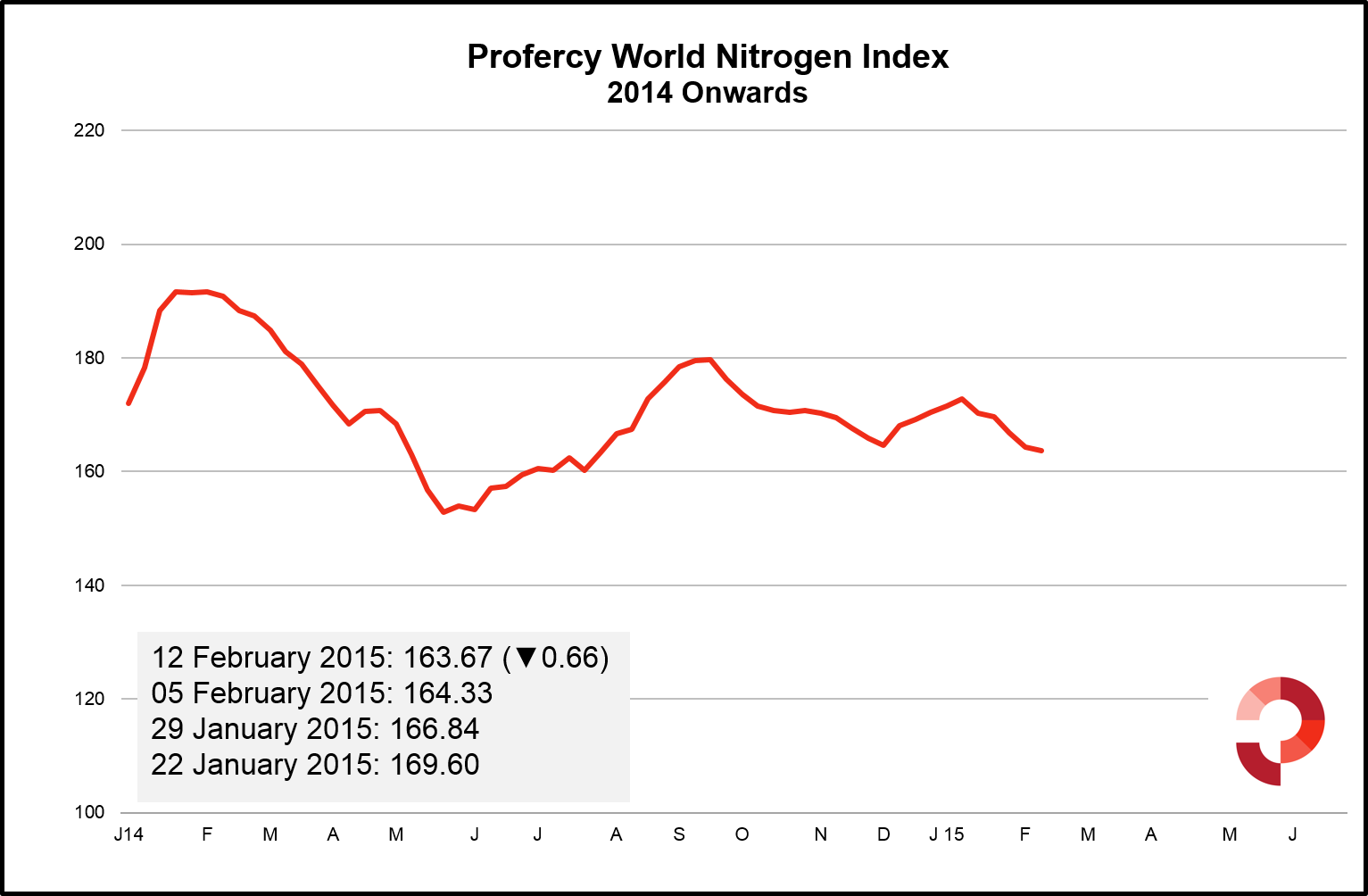

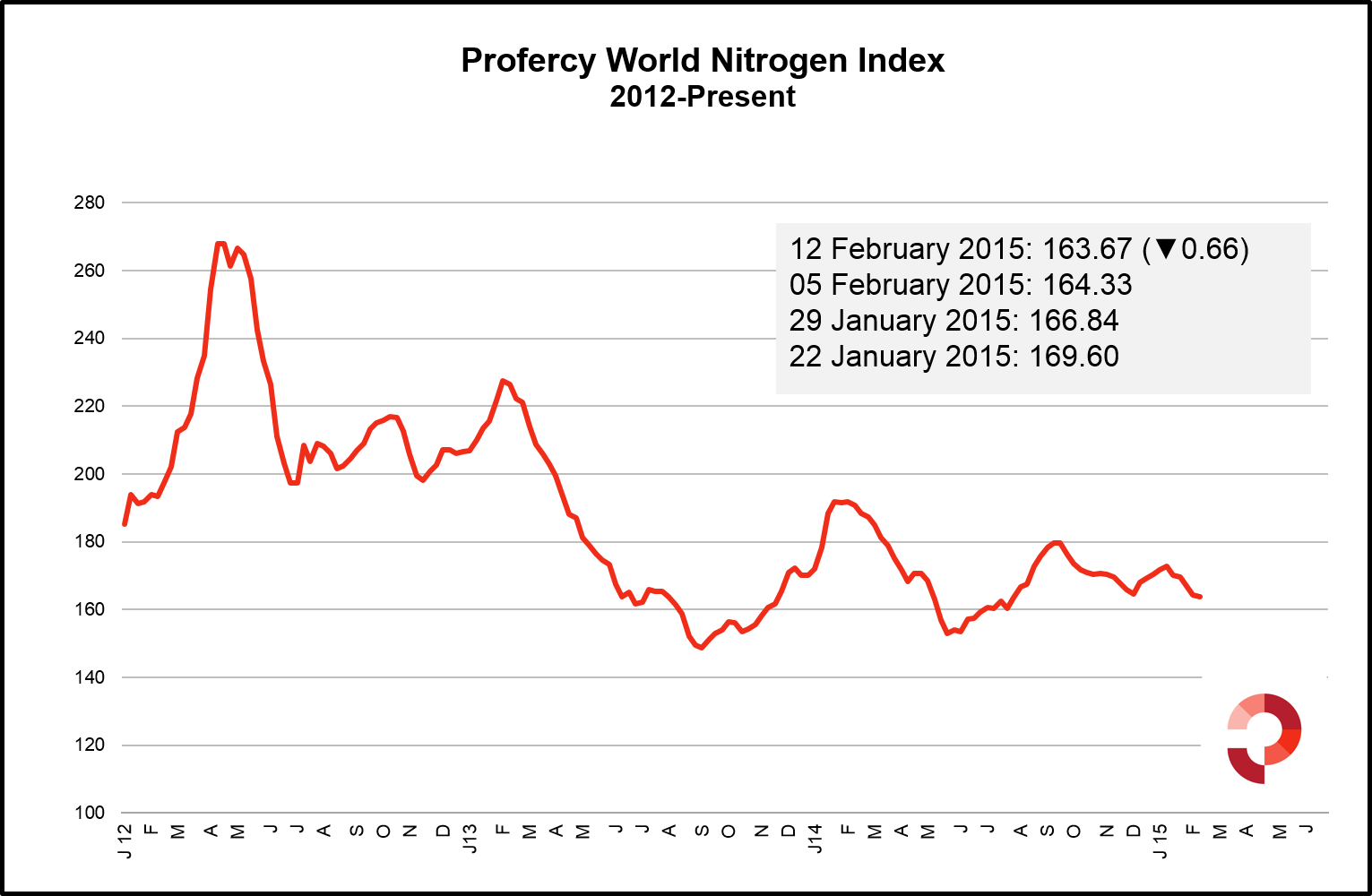

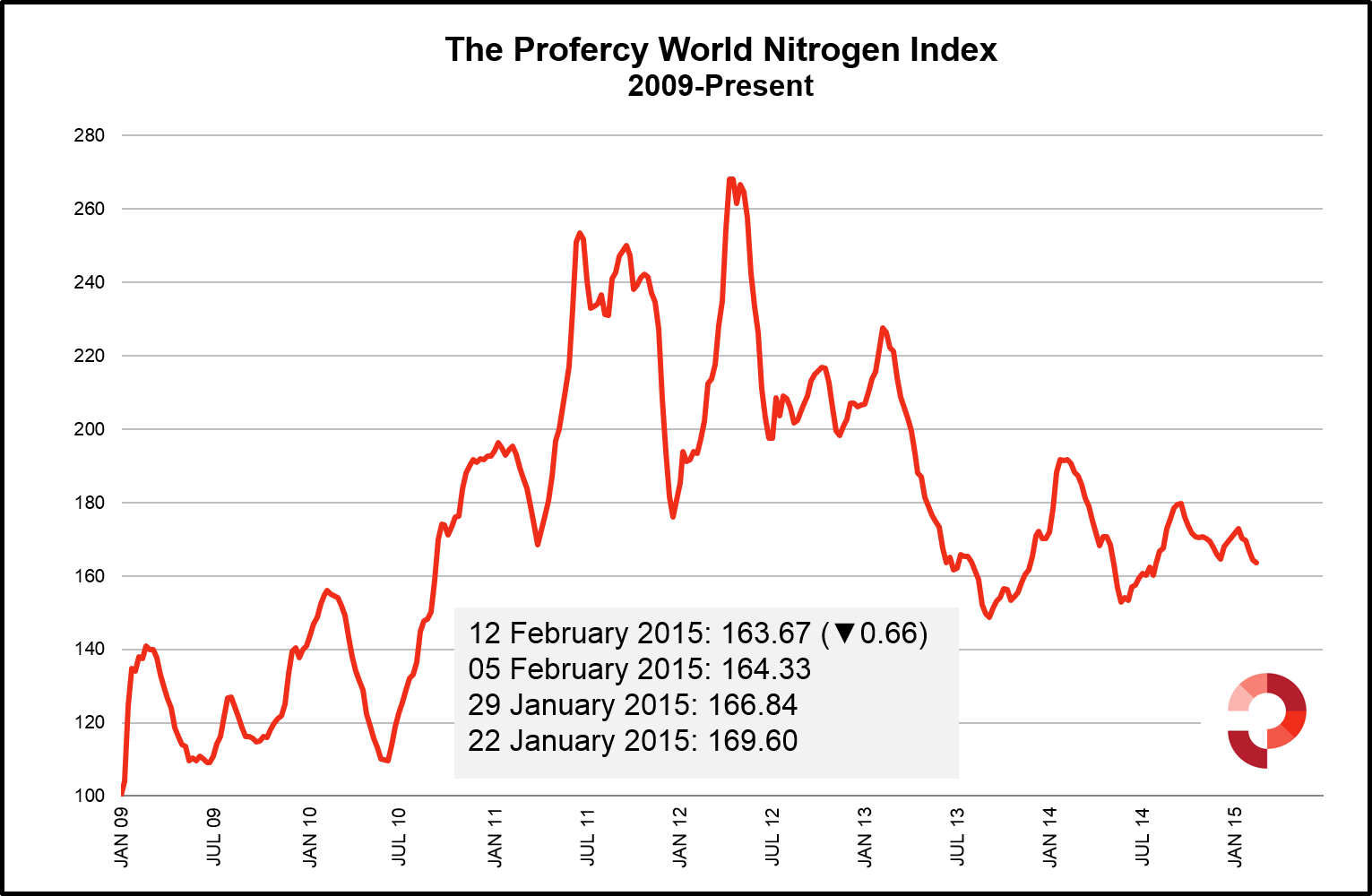

- Lower returns for granular urea in the West have seen Profercy’s Nitrogen Index drop 9 points since beginning of January

US Gulf urea barge values have fallen by nearly $30ps ton since the beginning of January. Prices have trended sideways over the last week with only a modest increase on the lows seen on 4-5 February. Urea barge values in the gulf are now marginally above $315ps ton fob Nola.

Weighing down on the market is the large import volume set to arrive through February and into March. While the latter month is set to be below last year, the US import program is well ahead for the season. The spring is expected to see favourable agricultural conditions but it remains to be seen whether product will move quickly through the system and onto retailers and farmers upriver. Anticipating a challenging environment for urea in Q2, paper offers for May have been made below $300 ps ton. Discussions of a floor value for US Gulf urea at the TFI Conference also suggested that the low for the year will be significantly below last year.

Globally, urea markets remain lacklustre. Prilled urea prices in the East have held for a number of week’s following the last Indian tender which saw over 1m. tonnes booked, primarily from China. However, it is noteworthy that this major sale failed to support an increase in prilled prices in China, which have been below $295pt fob for much of the last three months.

With no major gains for any nitrogen products, Profercy’s World Nitrogen Index fell 0.66 points this week and is currently at 163.67.

In this week’s Profercy Nitrogen Report:

- Urea: FSU prilled prices ease, European and US granular markets flat, the latest on netbacks for Middle East granular, Brazilian buyers play waiting game

- UAN: US exports to Europe

- Amsul: Turkish demand attracts cargoes from the East

- Ammonia: Markets flat in the West

- Over 45 key prices ranges for major nitrogen products and markets.

To receive the latest report, please click here and provide your details.

[tabs] [tab title=”Year to date”]

[/tab] [tab title=”2012 Onwards”]

[/tab][tab title=”2009 Onwards”]

[/tab][/tabs]

Free Trials of the Profercy Nitrogen Service

Profercy’s Nitrogen Service includes daily news, weekly analysis and monthly forecast reports. For more detailed information on specific products and individual markets, please sign up for a free trial or for more information on the Profercy Nitrogen Service, please click here.

Profercy World Nitrogen Index: Methodology

The Profercy World Nitrogen Index is published every week and is based on price ranges provided by the Profercy Nitrogen Service. This includes prilled and granular urea, UAN, AN, ammonium sulphate and ammonia. A full methodology can be found here.