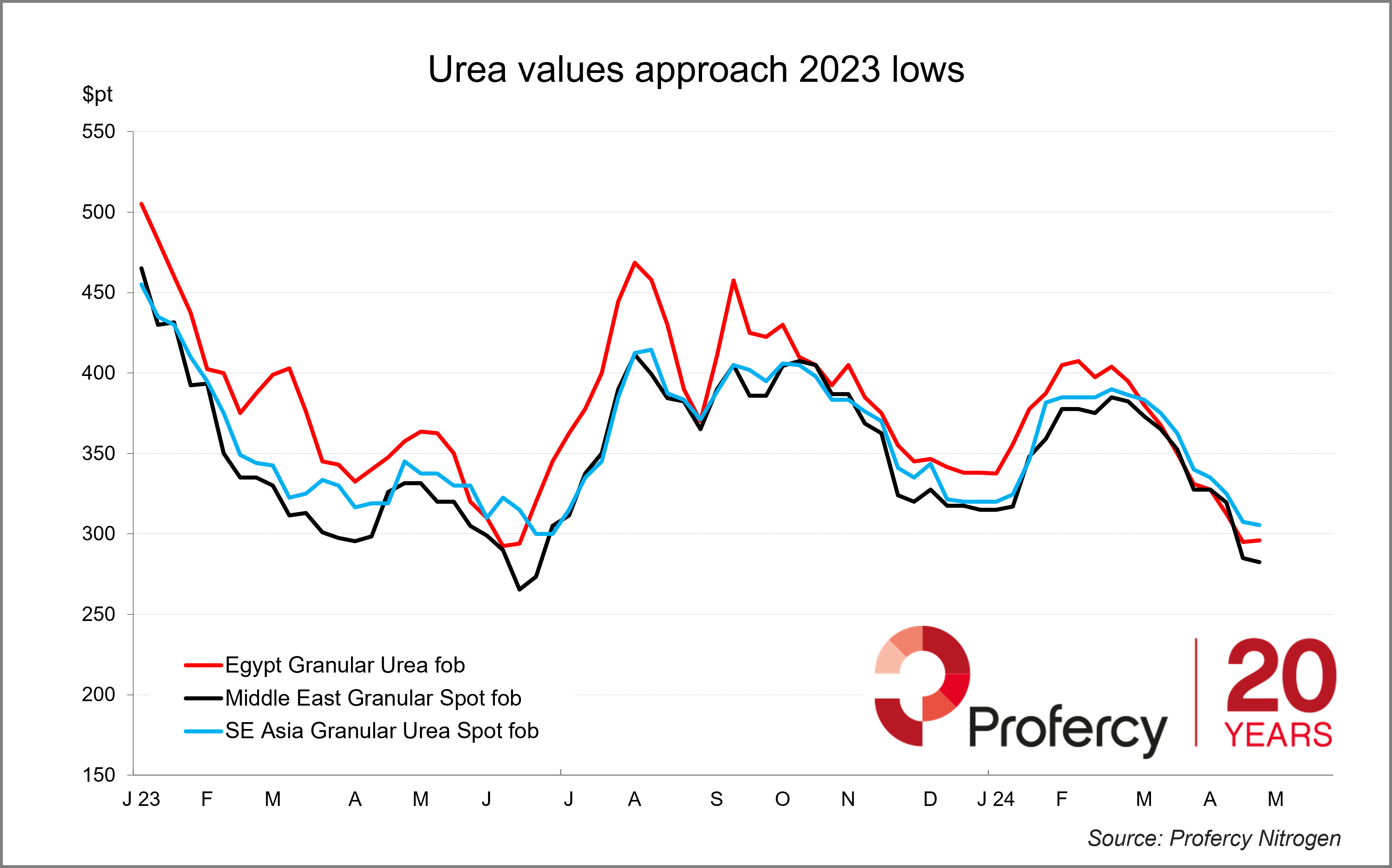

Global urea prices have been moving lower since they peaked in the second half of February. Middle East granular urea spot values were assessed by Profercy around $385pt fob just two months ago. Basis offer levels last week for May shipments, latest values are below $285pt fob.

Recent sales tenders in the east include those in Indonesia and Qatar. In the former, 85,000t of granular urea was sold just below $306pt fob, primarily for shipment to Australia, while prills were sold ex-Qatar at $290pt fob.

The early-Q1 run up was driven by a combination of supply side restraints, including those in Iran, Malaysia and Nigeria, and early demand in Oceania at a time when west coast Latin American, US and European inquiry was building. An early import tender in India also kept Russian prilled urea off the market for much January and February.

Stable supply and buyer deferral weighs on the market

Supply has been more assured since March shipments came into focus while seasonal demand in both the USA and Europe has been waning. India is in a comfortable position with high stocks, opting to book only moderate volumes in the early-April RCF tender.

For much of the past two months, buyers have been in the driving seat with most taking a last-minute approach to purchasing. Shipping disruption in the Middle East, as well as well documented tensions, have led to some price volatility in the market, but this has not resulted in any desire from importers to bring purchases forward.

China gets cold feet

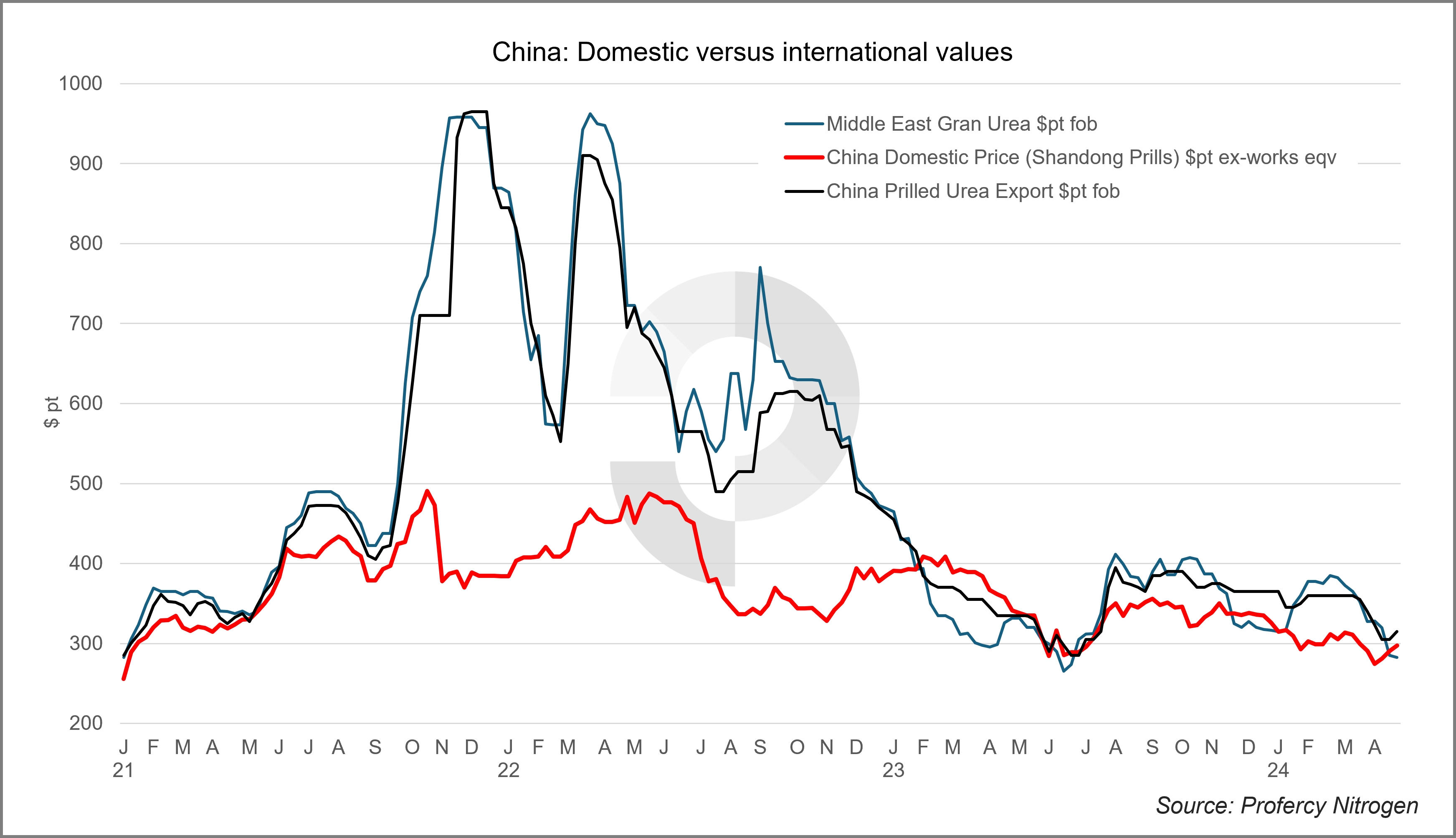

As has been the case for much of the past two years, the market has been eying export interest from Chinese suppliers closely. With the domestic season due to conclude in the coming months, suppliers had shown interest in shipments from early-May onwards.

Guidance earlier in the month from customs authorities had pointed to these being permitted with CIQ (China Inspection and Quarantine) inspection controls only anticipated at the factory. However, with domestic inventories low and some domestic demand yet to be covered, expectations of export business soon led to an uptick in domestic values.

With export controls ever sensitive to domestic pricing, inspection procedures have since been tightened with few believing major shipments will be possible until June at the earliest.

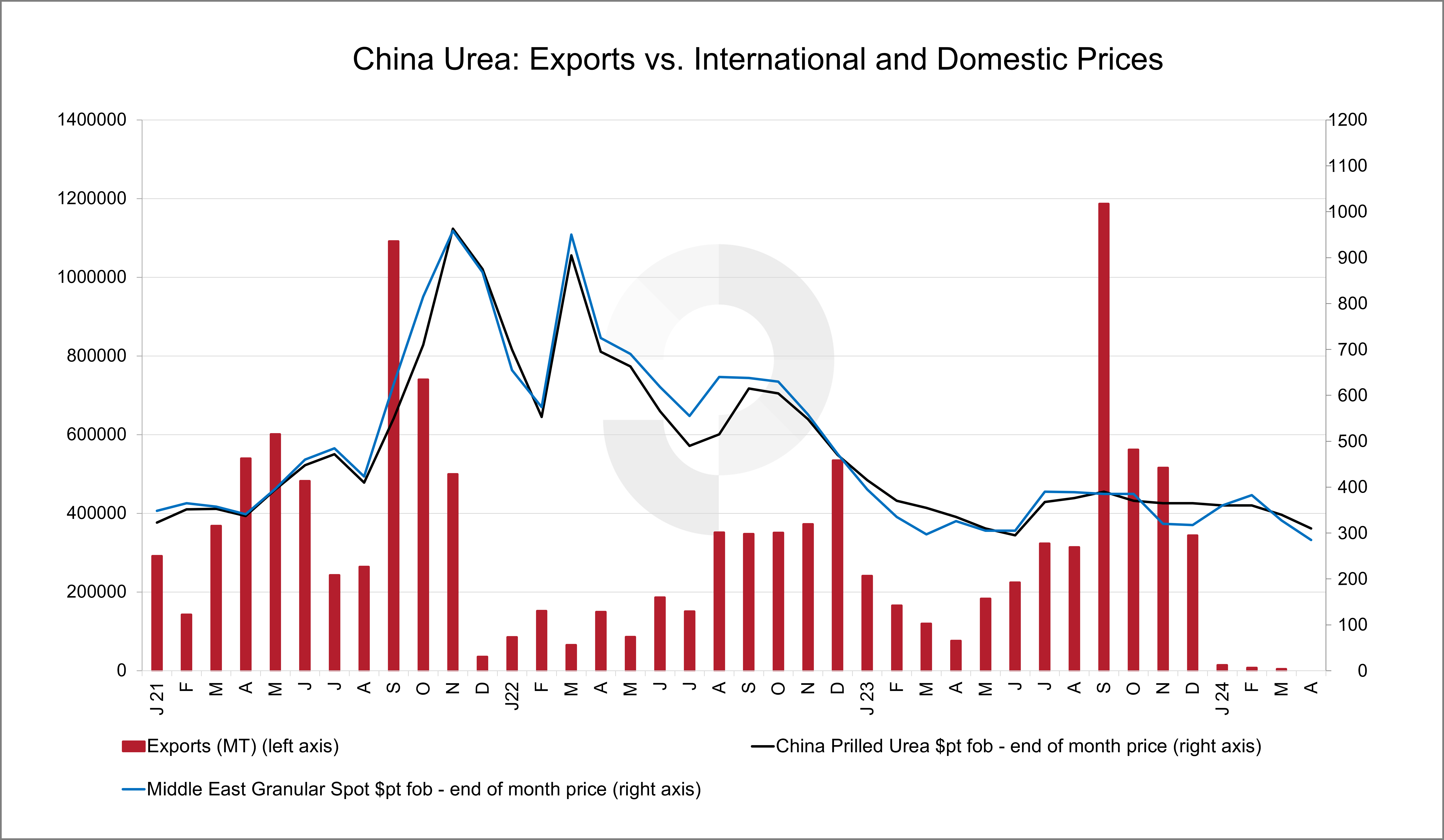

The recent relationship between international and Chinese domestic values is charted below, with the latter chart showing the relationship between overall export volumes and international values.

Export restraint in China played a significant role in supporting the Q3 price rally in 2023, although the subsequent wave of export business, primarily to India quickly pushed global trade balances into surplus.

Market approaches typically challenging period

Global import demand is usually at its lowest ebb in the June through August period. European and US demand typically wanes as the Spring application season draws to a close, while major Latin American inquiry is yet to build.

In the east, demand in Oceania and SE Asia can lend support to the market, while India has often played a major role in providing producers with an outlet. India’s role this year is far less assured with stocks healthy and well documented capacity additions bolstering domestic production rates.

Yet, globally nitrogen prices are at low levels relative to previous years, while grain values are not considered unhealthy. Nitrate and UAN supply in Europe is less at risk from high gas prices this year, although recent urea prices will be challenging for many producers once the current season ends. Chinese supply at lower prices is also uncertain with both production economics and the lack outlets for prilled urea likely to come into focus. Indeed, with India the only major outlet for prills, exports close to the 4.2m. tonnes committed last year may simply not be possible.

By Chris Yearsley, Editor of Profercy Nitrogen