Activity in the global ammonia market moved up several gears as participants digested a large hike in the closely followed Tampa contract for next month and awaited the fall out from a major plant shutdown in Saudi Arabia that will see at least 170,000t lost.

Activity in the global ammonia market moved up several gears as participants digested a large hike in the closely followed Tampa contract for next month and awaited the fall out from a major plant shutdown in Saudi Arabia that will see at least 170,000t lost.

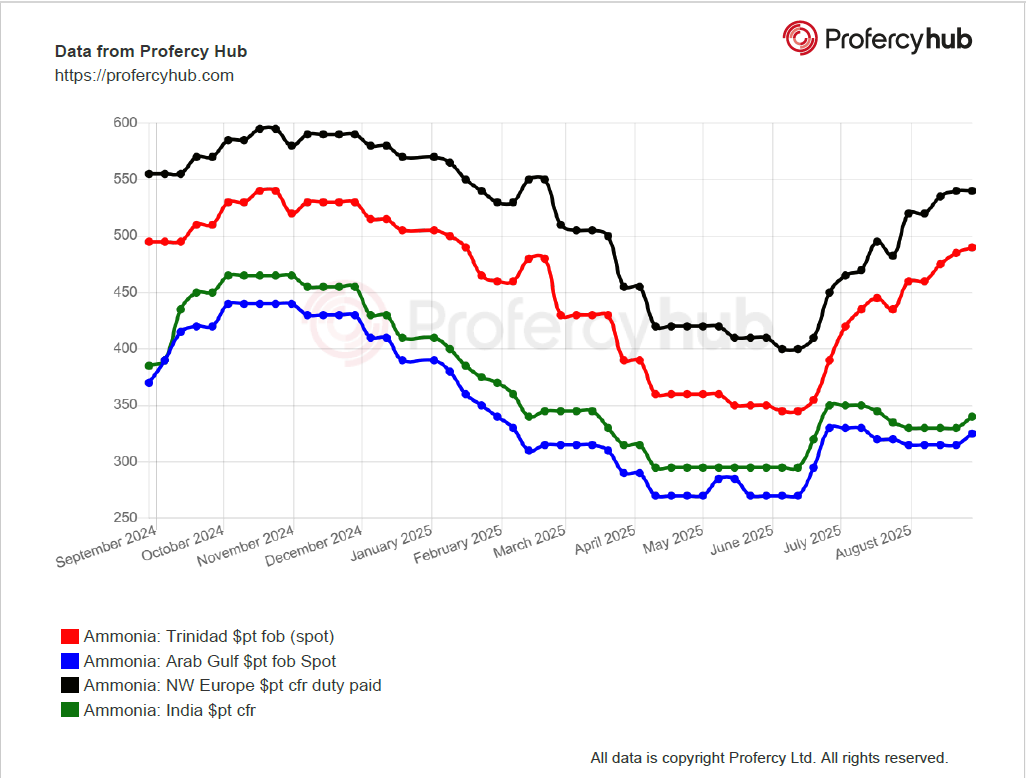

The settlement by Mosaic and Yara of the US benchmark at $540pt cfr for September, up $53pt from August, caught a few players off guard, though the figure is in line with recent spot business across the Atlantic.

Algeria’s Sorfert sold a combined 40-45,000t of spot material for September loading at Arzew at $517pt fob and $525pt fob, up around $20pt on last done, with that range matching cfr spot levels at leading import hubs in Northwest Europe

Capacity constraints in Algeria and Egypt have created upward price pressure of late. While the situation in the former has improved, as illustrated by the aforementioned sales, Red Sea tonnes are negligible for now due to ammonia being prioritised for urea manufacturing.

Even without the launch of new capacity in the US Gulf, export availability from the Americas is decent and several cargoes appear to have been sold into Northwest Europe for September arrival, albeit at undisclosed prices.

Those cargoes comprise much of the 100,000t of spot material that changed hands against a backdrop of a serious plant issue in Saudi Arabia that will remove almost double that figure from the merchant market.

The unscheduled shutdown of one of Ma’aden’s 1.1m tonne/year units for undisclosed reasons for up two months has caused disruption to exports from the region’s largest producer.

While the situation is still being evaluated, the loss of those seven, or more, shipments from Ras Al-Khair will certainly tighten the market East of Suez.

There has been little immediate reaction from buyers in India and Asia Pacific to that development, with players hoping decent availability at key export hubs elsewhere in the Middle East, as well as southeast Asia, will cushion the impact.

Bullish sentiment has been bolstered by seasonal natural gas curtailments in Trinidad – from where at least 300,000t is shipped per month – that are on the near horizon and often prompt producers on the island to carry out turnarounds or other maintenance.

By Richard Ewing, Head of Ammonia at Profercy