Sentiment and price direction in the global ammonia market is overwhelmingly driven by the upstream situation, rather than downstream conditions, and this certainly remains the case as the year nears its end and 2026 starts to come into focus.

Sentiment and price direction in the global ammonia market is overwhelmingly driven by the upstream situation, rather than downstream conditions, and this certainly remains the case as the year nears its end and 2026 starts to come into focus.

With producers in Trinidad facing natgas curtailments of 30% from this weekend for at least 10 days and Nutrien yet to give any indication about a restart of its four plants on the island, the supply/demand balance in the West is tight.

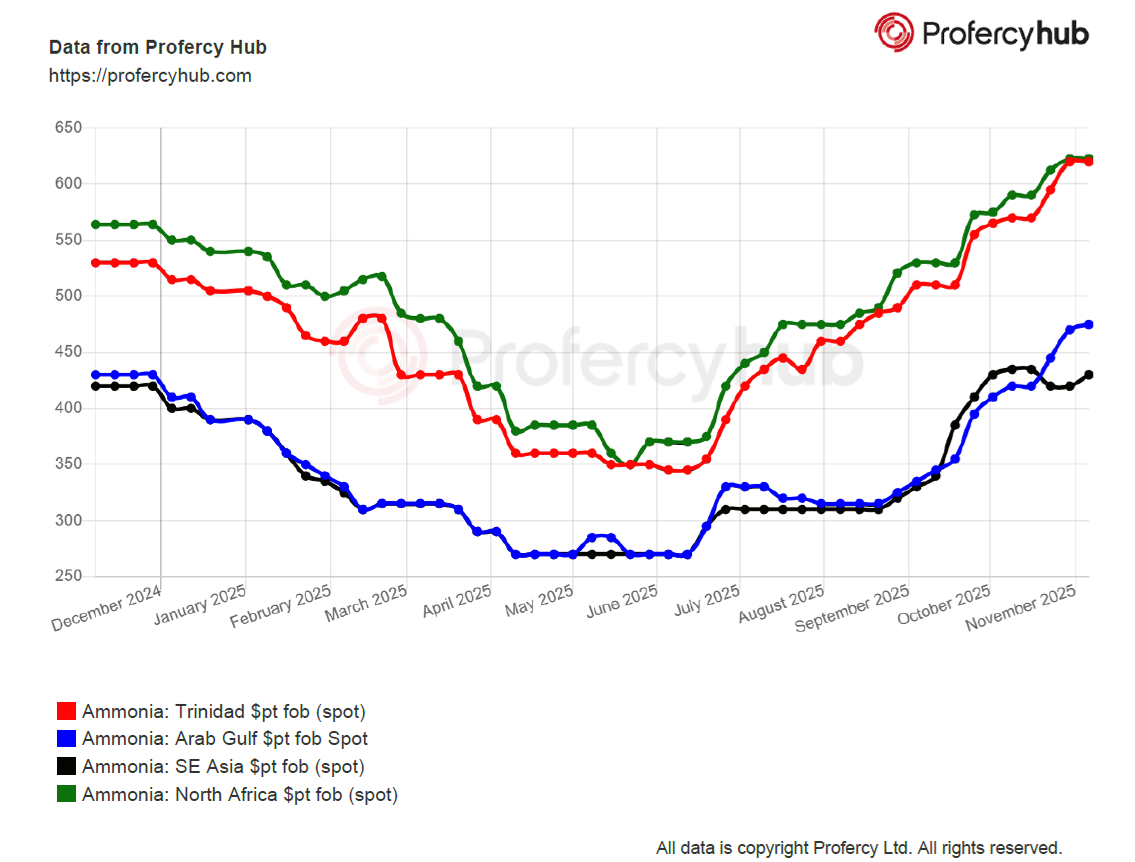

This lack of availability has been reflected in upward price pressure that has seen figures close to $700pt cfr duty free/paid talked about for December and January spot deliveries to buyers at key import hubs in Northwest Europe.

Opinion is split over whether that threshold will be broken given offshore values are now far higher than their onshore counterparts, despite natgas prices remaining at elevated levels compared to those seen prior to the conflict in Ukraine.

Relatively firm nitrates and phosphates prices mean some ammonia consumers are able to absorb the deeper dive into their pockets, but chemical manufacturers face a more challenging outlook, not just in Europe but also Northeast Asia – where plant turnaround season is well underway.

Indeed, stoppages at caprolactam (capro) and acrylonitrile (ACN) units in countries such as China and Taiwan, combined with strong ammonia plant run rates in Indonesia, have created a healthy surplus of competitively priced volume that leading traders are utilising for arbitrage opportunities in the West.

Although the vast majority of market players do not have access to the Red Sea and incur considerable extra freight costs around the Cape of Good Hope, the wide East-West price gap means such openings are decent.

Mitsui recently loaded a total of 23,400t at several Chinese ports for shipment to Morocco, while a similar-sized cargo sourced from a chemical production complex at Lianyungang is heading to two recipients in South Korea and India.

With North African producers mainly sold out and given this month’s sharp drop in exports from the Caribbean, buyers in the West bar those in Turkey – who can receive discounted cargoes from Iran/Oman – will have been pleased to hear about the imminent restart of a large plant in Saudi Arabia.

Ma’aden’s announcement that export availability should return to normal next month will introduce an extra 75-100,000t per month to the market. The unscheduled shutdown of one of its three 1.1m. tonne/year plants in August is one of the drivers of recent upward price pressure.

Next door to the Kingdom, a Qatari spot cargo was sold to a trader at, or close to, $500pt fob for shipment to one or more ports in the West, but outside of some sales from Iran/Oman to Turkey at around $600pt cfr, the market was quiet.

Spot activity is expected to pick up as the month progresses, especially in Europe given EU-based buyers who receive cargoes from 1 January will be subject to the controversial new Carbon Border Adjustment Mechanism (CBAM) duty that will mean an extra financial burden.

Such buyers will be watching the Trinidad situation closely given the Nutrien shutdown has cost the market 85,000t per month. The Canadian major idled indefinitely its four plants – which between them exported over 1m. tonnes in 2024 – two weeks ago in a row over port access and feedstock issues.

By Richard Ewing

Head of Ammonia/Deputy Editor at Profercy