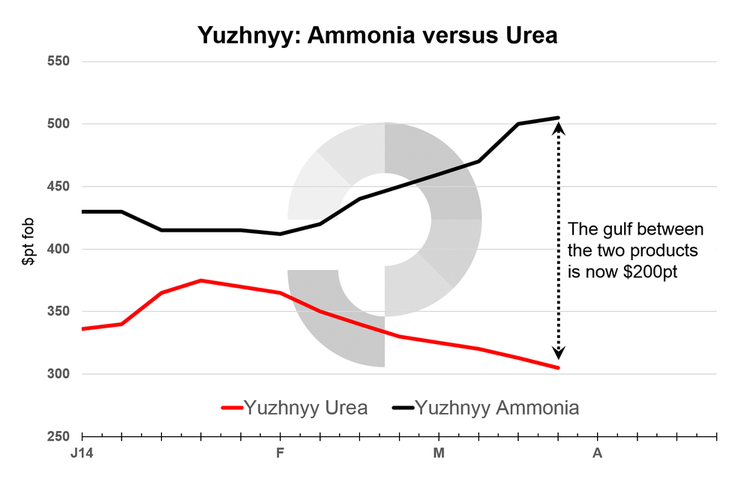

- The gulf between Yuzhnyy ammonia and prilled urea is now $200pt. Buoyant demand in the US and supply cutbacks and uncertainty have supported the increase in prices.

- While ammonia prices can be volatile in the short term, in the long run prices tend to follow urea and other nitrogen products.

- Supply-side factors, particularly production in the Ukraine, will be a major area of focus in the coming months.

Unlike other nitrogen markets, the ammonia market remains firm with the gulf between Yuzhnyy ammonia and Yuzhnyy prilled urea widening. In addition to significant gains for Yuzhnyy ammonia prices in the last two weeks, the April Tampa cfr price between a major US importer and a major producer rose by $120pt fob. The increase comes at a time when prices for urea, the dominant international nitrogen product, have fallen for seven straight weeks.

Yuzhnyy ammonia prices $200pt greater than Yuzhnyy prilled urea

The gulf between Yuzhnyy ammonia and Yuzhnyy prilled urea prices is reflected below – the prices shown are the high end of Profercy’s quoted range for each week. The port represents up to 20% of ammonia trade – a figure brought into focus by the recent political turmoil in the Ukraine.

A number of supply side factors have supported the increase in Yuzhnyy ammonia prices. Towards the end of February, the political situation in the Ukraine led to uncertainty in the market, with buyers opting to lock in product. All eyes remain on Ukrainian production with some producers expected to see notable gas price hikes in April and May. Production problems and turnarounds in North West Europe are another contributory factor.

Demand has also been buoyant in recent weeks and indeed March Yuzhnyy ammonia was sold out well before the middle of the month. With the US utilising all product available in the Caribbean, the largest exporter of ammonia, this has enhanced demand for product in the Black Sea.

Prices based on the high end of Profercy’s quoted range for both products. Yuzhnyy urea prices reflect prices for prilled urea (as opposed to premium granular product).

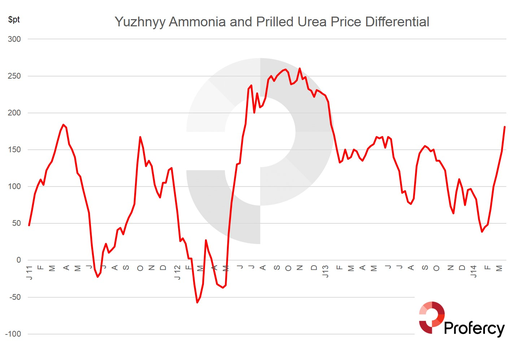

Long term correlation, despite short term volatility

Over the long term there is a very strong correlation between all nitrogen prices, with urea normally shaping market prospects. As we have seen already, ammonia prices can prove to be volatile, reflecting the inherent problems on the supply-side and changes in production. This was most evident throughout July 2012 to June 2013 when Yuzhnyy ammonia prices rose to nearly $650pt fob (in October 2012), some $260pt fob greater than the price of Yuzhnyy prilled urea. While the average price differential between the two products between 2009 and 2011 was less than $50pt, from 2012 to the present, the differential has been greater than $120pt.

While there is a long term correlation between urea and ammonia, prices for ammonia can be volatile in the short term. The above graph is based on the average of the quoted range for both products quoted by Profercy Nitrogen.

Where next?

As mentioned above, supply side factors play a significant role in global ammonia markets. The market will be keen to understand the implications of higher feedstock prices for some Ukrainian producers in the coming months and any developments regarding supply cutbacks in North West Europe and North Africa. Another key consideration will be whether Black Sea producers opt to produce greater volumes of ammonia rather than competing in already competitive urea markets. On the demand side, it is unlikely that strength in the US will continue through all Q2, easing the pressure on those reliant on product from the Caribbean and Yuzhnyy .

Profercy provides analysis and market information on all urea and ammonia markets through the Profercy Nitrogen Service. The Service includes regular news updates and analysis, alongside a comprehensive weekly assessment of global markets and prices. Other products covered in the report include ammonium nitrate, ammonium sulphate and UAN. For a free trial of the service or for more information, please click here.