Source: Profercy Nitrogen

Supply uncertainty remains front of mind in the urea market with production once again constrained in Egypt by feedstock issues while China has shown little interest in engaging with the international market.

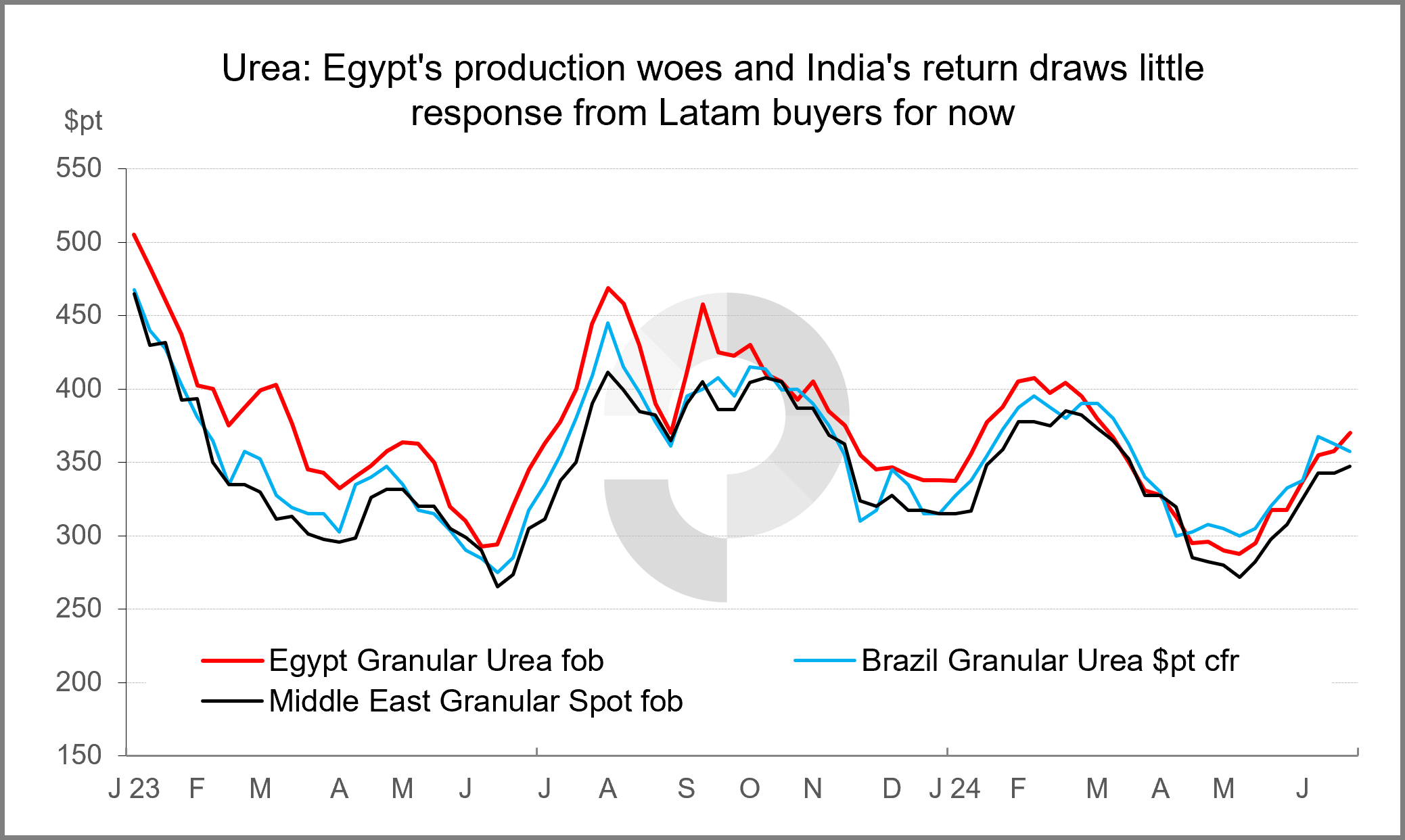

Yet, with values having already advanced considerably since mid-May, business has been slow in the past week. Importantly though, most producers are now committed for July, while few buyers have been chasing August shipments.

Notably, major western markets, primarily those in Latin America, have not responded to latest supply concerns. However, in the east, India has given the market two weeks’ notice of a tender for shipments to 27 August.

The earlier gradual resumption of gas flows in Egypt last week proved to be a false start with operating rates slashed from 23 June. The wider energy crisis in the country continues to impact producers and will ensure that a major portion of June sales will be supplied in July. As noted previously, as much as 22,000t/day of production is being lost.

Importantly, this has come as European buyers are withdrawing, limiting the impact on North African fob prices. Warehouse values across Europe are firm, but recent spot vessel business has been confined to small shipments ex-Algeria at $370pt fob or above. Long haul markets net back to well below these levels.

Looking to Latin America, suppliers needing to place tonnes have made sales in Brazil with values little better than $360pt cfr. Soft grain values, forex issues and timing have kept major importers on the sidelines, as they have done in other markets. Demand has also cooled in Argentina.

In the east, production in Malaysia is reduced while most producers in the region have good order books as they benefit from a lack of offers ex-China. With inventories low and domestic values at elevated levels, authorities in China have shown little interest in relaxing inspection controls and allowing exports of urea.

Inquiry has been light in the east, bar some checking for Thailand and Australia. Yet, India’s return offers producers a chance to extend sales through August, subject to the volume sought. Urea inventories are healthy in India, so a major purchase may not be necessary. Equally though, with China absent, major participation would be required from Russia or the Middle East in order for close to 800,000t to be secured.

By Profercy Nitrogen