Producers, distributors, traders and importers all had a hand in the US Gulf Nola spot barge market this week.

A key focus of discussions this week have been the logistical problems caused by high water levels and the continued negative sentiment in the international urea market. Indeed, these have been issues for several weeks now. Given these logistical issues, Nola netbacks from the inland terminals have, in places, been over $10ps ton above what spot barges has been trading at in Nola.

As a consequence of the above factors, distributors have been content buying significant volumes of imported urea below $234ps ton fob Nola for end-March/April with over 25 barge trades or 37,500 short tons of urea concluded this week. Distributors have shown little interest in selling barges in Nola despite bids climbing up to $238-240ps ton fob by mid-week for first half March barges. Of note, most, if not all, distributors have contractual barge arrangements and are much less impacted by the logistical disruptions than importers.

Most of the urea purchased this week has been from importers and international traders who do not have logistical networks or distribution inland, nor contractual barge arrangements. Sales by importers for second half March and April barges were noted below $230ps ton fob.

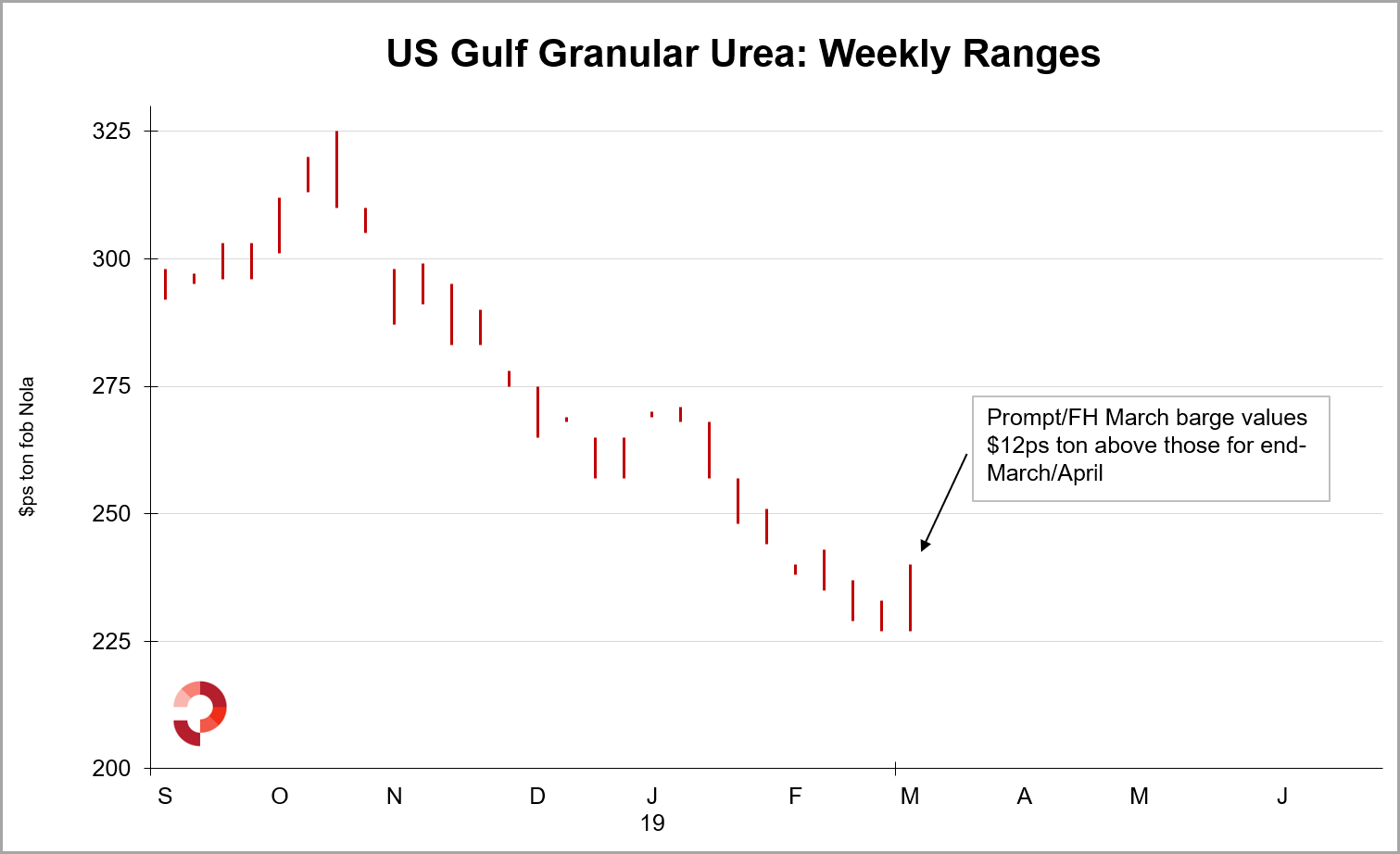

Meanwhile, domestic producers have not been actively selling March barges with some even in the market to buy. This near-term demand has led to an acute tightness for first half March barge availability. As a consequence, and as demonstrated by the chart below, the differential between prompt and deferred barge values has stretched to over $10ps ton.

Looking further ahead, while there is no sign of an early spring in the US bringing forward demand, many suppliers remain optimistic regarding the prospects for Q2. This is primarily due to the forecast corn acreage of 93m. tonnes, as well as the anticipated switching from ammonia to other nitrogen products due to the poor fall weather.

By Michael Samueli, Nitrogen Market Report

E: Michael.Samueli@profercy.com

All prices basis Profercy Nitrogen Weekly Report.