Urea prices remain under pressure worldwide. Buying for spring is continuing in the USA and Europe, but it is now too late for either market to pull in large volumes for the current season and too early for the next. Solid Australian demand plus the announcement of a new Indian tender this week are welcome for producers but, alone, will not counter the demand contraction for new cargoes in the western hemisphere. Thus, the bearish trend looks set to continue.

India is expected to target 750,000t of urea in its 7 May inquiry for shipment to 10 June but has licence to buy a large volume. Purchasing for the west coast will be prioritised given the majority of shipments under the last tender were for the east coast. The weak freight market ensures that there will be strong competition from FSU and North African suppliers (Egypt and Algeria) as well as the more traditional sources of the Middle East and China.

With prices expected to be in the $230s pt cfr versus the $250s pt cfr in the last tender, China may struggle to compete. However, some producers will no doubt look to sell in a chase for much-needed cash. Also, China’s industry is operating at over 70% of capacity producing 160,000t/d and the domestic market is not witnessing higher prices.

While India could buy a bigger volume, the country is not in a peak demand phase. April production was 1.81m. tonnes, up from 1.65m. tonnes in April 2019 while sales were just 1.1m. tonnes, albeit almost 300,000t up on last year. Imports were marginally higher bringing the total monthly surplus (production + imports less sales) to 0.93m. tonnes. The first month where domestic production is normally heavily short of demand is July which does give India time to hold further tenders to take advantage of even lower prices.

Away from India, this week has seen further price reductions conceded by producers in the FSU, Egypt (down $10pt) and in Brazil where granular business was concluded at $220-225pt cfr. The US Gulf market is little changed from last week but forward sales for Q3 have taken place below $200ps ton fob Nola pointing to sub-$200pt fob North Africa.

Profercy’s next regular urea forecast report is due out shortly. To register interest, please contact us at fertilizers@profercy.com

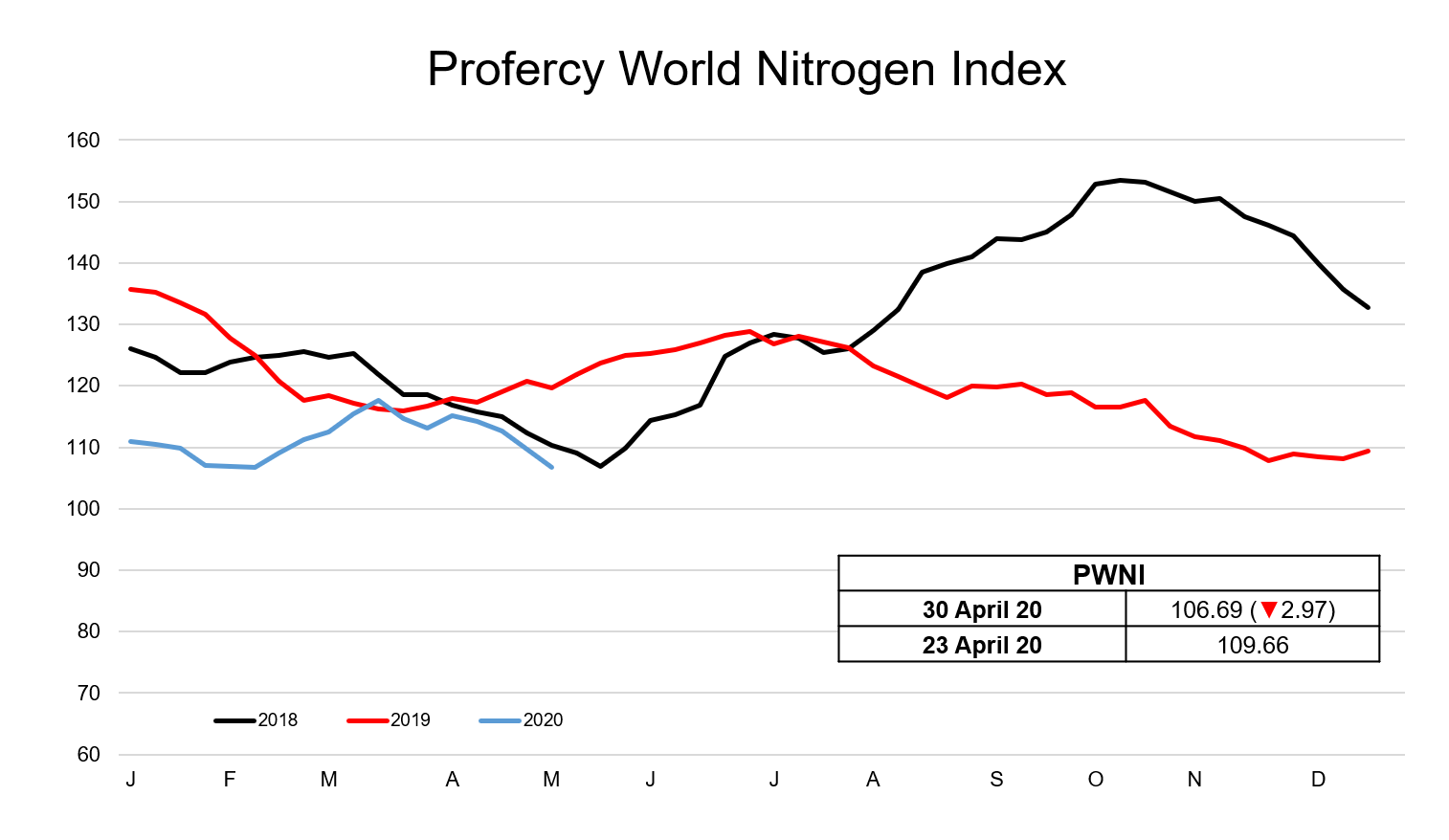

Nitrogen Index declines by nearly three points