Global urea prices have been on a downward trajectory since September last year and are now closer to Q2 2021 levels. In contrast to much of 2022, producers have struggled to build order books so far this year.

Nearly every major exporting region has ample availability of urea for February shipment. Producers in the Arab Gulf have been heavily utilizing offtake arrangements, with others placing product in the hands of traders on formula. Algerian producers have also been utilizing formula sales.

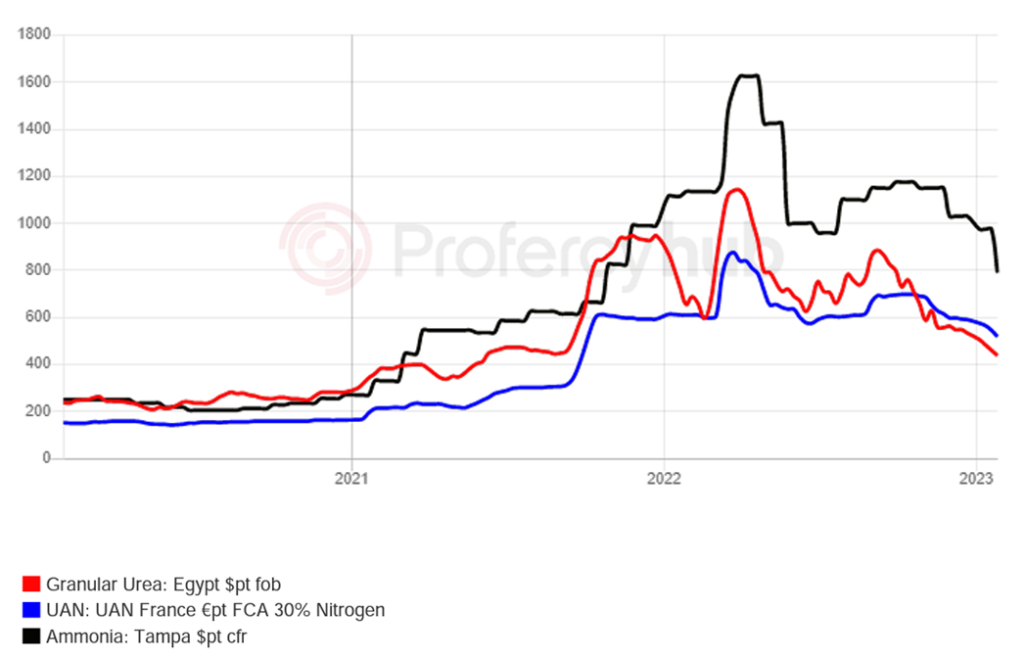

As a result, Egyptian producers have been struggling to find interest at $430pt fob. By comparison, Egyptian prices peaked at $900pt fob in September 2022. Over the same period, Arab Gulf fob values have declined from a high of $720pt fob to below $400pt fob this week.

Elsewhere, Russian producers have been moving product either into their own distribution systems or the distribution systems of long standing partners in the USA, Europe, Brazil and Latin America. Spot sales are increasingly rare as buyers aim to avoid purchases while the markets still appear to be declining.

Fundamentally, the lack of demand, especially from India, is stifling producer efforts to reverse the situation. Reports of an Indian tender were first circulating in early December, but a decision on a tender has been continually delayed and appears set to be delayed further.

Indian needs for the current season appear to now be satisfied by domestic production and stock, with some reports suggesting recent sales for January have been lower than previously anticipated. As such, any future tender will be to rebuild stocks for the next season, implying there is no immediate rush.

Elsewhere, markets are in the offseason or in the case of the USA, demand is yet to emerge despite indications that net urea availability in the US is well behind requirements. Buyers appear confident that enough time remains to import urea ahead of the season and without India, the US is not expecting to face any significant competition for tonnes.

The situation is not limited to downstream products like urea, nitrates and sulphates.

The rapidly increasing length in the global ammonia market was illustrated starkly by a steep fall in the Tampa contract for February loading, a move that took the US benchmark back to levels last seen in late 2021.

The settlement of the key benchmark price at $790pt cfr – down $185pt month on month – came amid falling natgas prices in Europe, and extremely weak demand from industrial and agricultural buyers.

The decline in gas prices in Europe means that it is still theoretically cheaper to produce than import ammonia, even given recent price declines in the global ammonia market. This again is in stark contrast to much of 2022. Indeed, it was this European demand for seaborne ammonia that had been the central driving factor for the high ammonia prices over the last year or more.

By Michael Samueli, Nitrogen Daily Editor