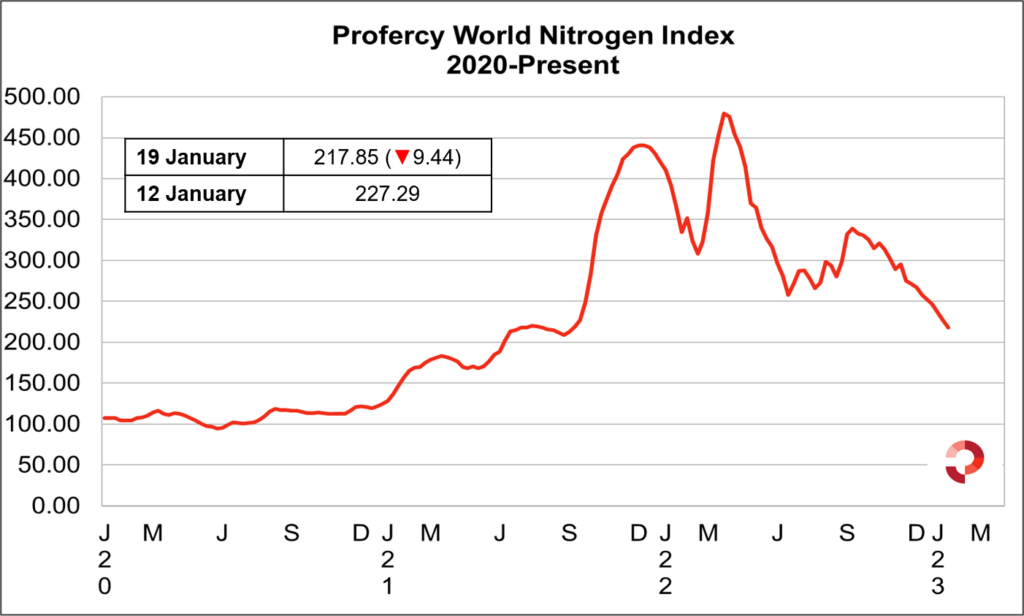

With demand for nitrogen products yet to show signs of picking up this year, values have once again tumbled and resulted in the Profercy World Nitrogen Index (PWNI) declining 9.44 points to 217.85 this week.

In the urea market, many producers/suppliers continue to pin their hopes on liquidity improving following the anticipated Indian purchasing inquiry. Whilst some reports suggest the next inquiry could be announced for early February, as yet there has been no firm news from the south Asian importer.

With demand from most regions limited, urea producers both east and west still have uncommitted January/February volumes. Several have resorted to selling on a formula basis, whilst others have been gradually lowering offers.

In Egypt, there were multiple reports that some producers had sold granular urea at $450-455pt fob this week, down $20-25pt fob from business that took place a week ago. While in Southeast Asia, granular sales took place to traders covering short sales into nearby markets $35pt lower than earlier this month.

While many had also hoped for demand to emerge from Europe as the season approaches, this has not been the case so far this year. Buying has generally been hand to mouth. With inventories high and offshore availability plenty, buyers remain content to sit out of the market. Furthermore, with forward gas prices in Europe falling further this week, buyers remain hopeful that lower production costs will allow producers to also reduce nitrates prices.

In Nola, significant business took place late last week for deferred months which led to a pick-up in barge values, however the demand slowed down as the week progressed. Additional volumes have been booked from the Middle East and elsewhere for shipment in the coming weeks. Indeed, with demand from other importers lacking, suppliers have been shipping both formula and spot cargoes to the US ahead of spring demand. With high levels of exports and low imports seen by the US earlier in the season, many continue to look west for when the Spring buying season kicks in.

Owing to the continued weakness across the nitrogen markets, the PWNI has shed some 78 points since mid-November. Values are now around the levels last seen in September 2021, prior to the rapid ascent seen in nitrogen markets owing to sharp increases in European gas prices at that time.

By Neha Popat, Nitrogen Market Reporter